If you’ve ever spent time in a city like San Francisco or Milan, you know that fog usually creeps in overnight—unnoticed until you wake up in the thick of it.

Financial “fog” at an agency can feel the same way.

Seemingly out of nowhere, cash gets tight, a retainer client drops, and now, you’re not sure you can cover payroll.

And although this financial trouble feels sudden, there are almost always clues leading up to it.

In chatting with successful agency leaders, we’ve identified eight common red flags that signal your agency’s finances might be drifting off course—and how to fix them before they get even worse.

1. You’re not seeing real financials until it’s too late

Without timely financial data, it’s easy to miss warning signs and make poor decisions, like overhiring or underpricing.

And reviewing the wrong data is just as costly. As Spicy Margarita founder Ben Goodey, told us:

One big financial red flag is an over-focus on revenue numbers instead of profit. Monthly profit should be an agencies’ north star metric.

When you focus more on revenue than profitability, you can artificially inflate your understanding of how much money you really have as an agency.

For example, a big project that brings in $100,000 in revenue looks great on paper. But say your external costs were $10,000 and your labor costs were $85,000.

That leaves you with just $5,000 in profit—making the project way way less valuable than you assumed.

To avoid costly issues with your numbers, do two things:

- Review your agency financials regularly. Review your profit and loss (P&L) statements and balance sheets monthly, by the 10th of each month. This helps keep you on track and gives you time to make changes to pricing, pipeline, or staffing (see more tips on this below).

- Look beyond revenue: While revenue is important, it’s not the only metric that matters. You want to gain a bigger perspective—and pay extra close attention to your project margins. The goal is to keep them between 55-75%, reflecting a healthy balance between pricing and costs.

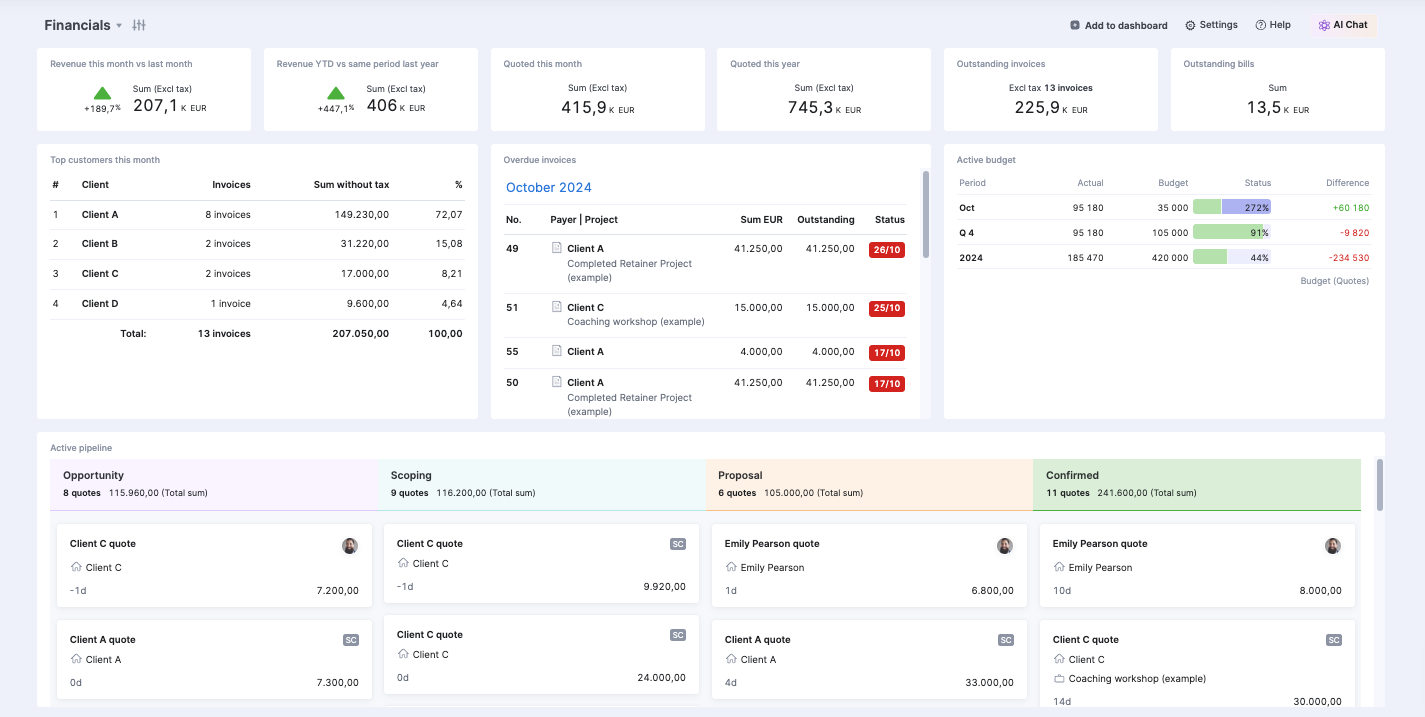

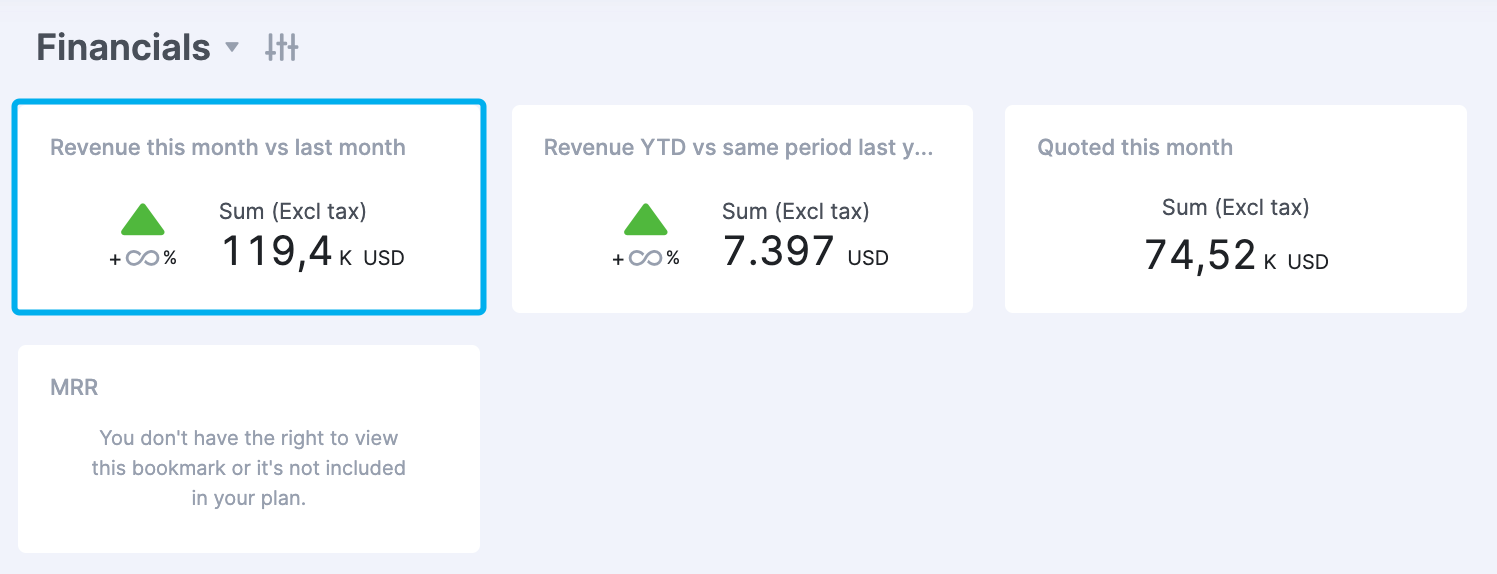

Use Scoro’s executive dashboards to stay on top of real-time financial KPIs like:

- Revenue

- Profit

- Proposal win percentage

- Forecasts

- Budgets

This way, you can get the full financial picture at any moment and make decisions that align with your agency’s true financial health.

2. Your AGI per employee feels … off

Agency gross income (AGI) per employee is a key metric that should influence pricing and staffing decisions.

AGI is revenue minus the cost of goods. Your AGI per employee shows you how much revenue per employee you’re earning. This shows you how much money you actually have to run your agency.

Drew McLellan, CEO of Agency Management Institute, says a good benchmark to shoot for is at least $150,000 AGI per employee.

He adds that if you start dipping below $130,000, your employee costs are almost certainly eating into your profit margins. This can come from overstaffing, underpricing, or low billable utilization.

Calculate your AGI per employee with the following formula:

AGI per employee = (AGI) / # of employees

Run this calculation quarterly. If you find it’s lower than you anticipated, take action:

- Raise pricing to increase the amount of revenue you’re bringing in

- Reduce your full-time team size or adjust your team make-up to use more part-time freelance or contract talent to account for ebbs and flows in project demand

- Review your team’s team’s billable utilization and look for ways to increase it (if needed)

3. Your producers’ billable utilization is too low (or too high)

Billable utilization is the percentage of time your team or individual employees spend on work that directly generates revenue and can be billed to clients.

Say a team member works 40 hours each week and spends 30 hours on client work and 10 hours on internal meetings and trainings. Their billable utilization would be:

(30 billable hours / 40 working hours) x 100 = 75% billable utilization

Billable utilization targets depend on roles:

| Role | Focus | Target |

|---|---|---|

| Producers and freelancers | Focused on client work and delivery | 75%–80% |

| Managers | Focused on managing delivery and clients | 35%–50% |

| Sales team and admin | Focus on pipeline and business management | >10% |

When producers’ rates are consistently under or above the target range of 75-80%, you’re jeopardizing your finances.

Why?

Because low billable utilization signals inefficient team use and missed opportunities to bring in revenue.

As a result, you face lower profit margins and AGI per employee. And if your profits can’t cover your costs, you risk not being able to pay your expenses in the near future.

High billable utilization often leads to burnout, reduced work quality, and client dissatisfaction—all of which impact your bottom line.

Tracking these metrics also helps you make more informed staffing decisions.

Freia Muehlenbein, Agency Growth Consultant and Owner of Be Reyt Agency Advisory told us:

Low numbers mean that you have likely overhired, whereas high numbers mean you might need to recruit … If your teams are feeling busy and stretched, check if your numbers reflect this.

Avoid resource utilization issues at both ends of the spectrum by tracking billable utilization monthly.

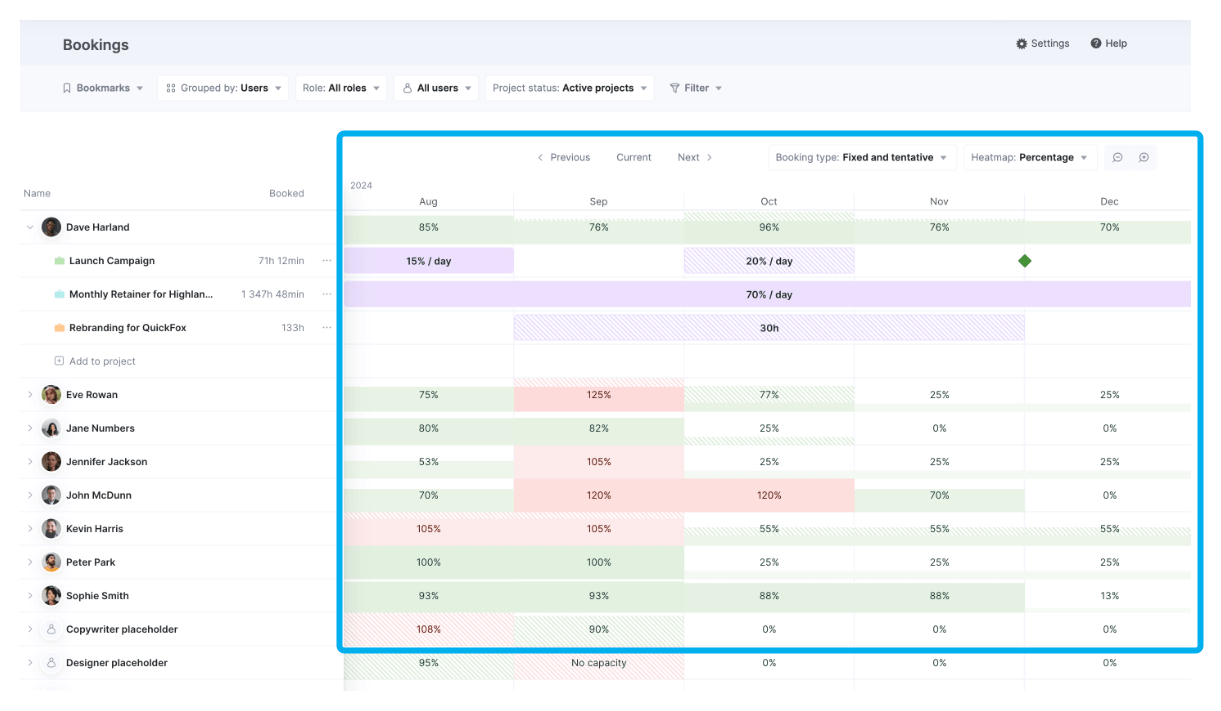

Make it easy with agency management software like Scoro.

Use the platform’s bookings view to quickly identify under- and over-utilization and take steps to remedy it.

Like shifting work from a team member with too many projects to someone who’s underutilized.

Green represents booked work, while white space means team members have availability for more billable work. And red means the team member is over 100% capacity.

4. You’re underpricing your services

As Ben Goodey notes, undercharging either leads to “giving a subpar experience because you need 20-plus customers to turn a profit, or you’re stressed out and overdelivering.”

One key indicator that you’re underpricing? Consistently winning almost every deal.

Winning 80-90% of proposals sounds good.

But taking on so much work without real consideration can quickly lead to burnout, cash flow issues, and low margins.

To fix this, start by reviewing your proposal win rate. A healthy range is around 25-33%.

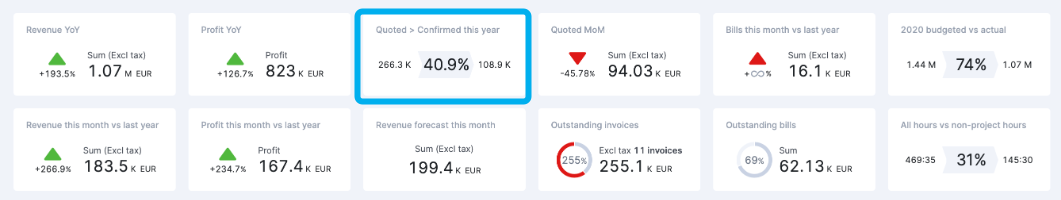

Track this automatically in Scoro with the “Quoted > Confirmed this year” KPI widget on your dashboard.

Aim to have a balance of healthy proposal wins (around 25-33%) and healthy profit margins (15-35%).

The higher you are in that healthy range, the more flexible you can be with raising prices on future proposals.

When you’ve reached max capacity, test doubling your rates and see if you still close customers. Then, slowly replace lower-paying clients with high-paying ones. You’ll quickly see you could’ve charged three or four times what you were—and people are still happy.

And make sure you create a clear process to qualify leads and check your margins for every proposal.

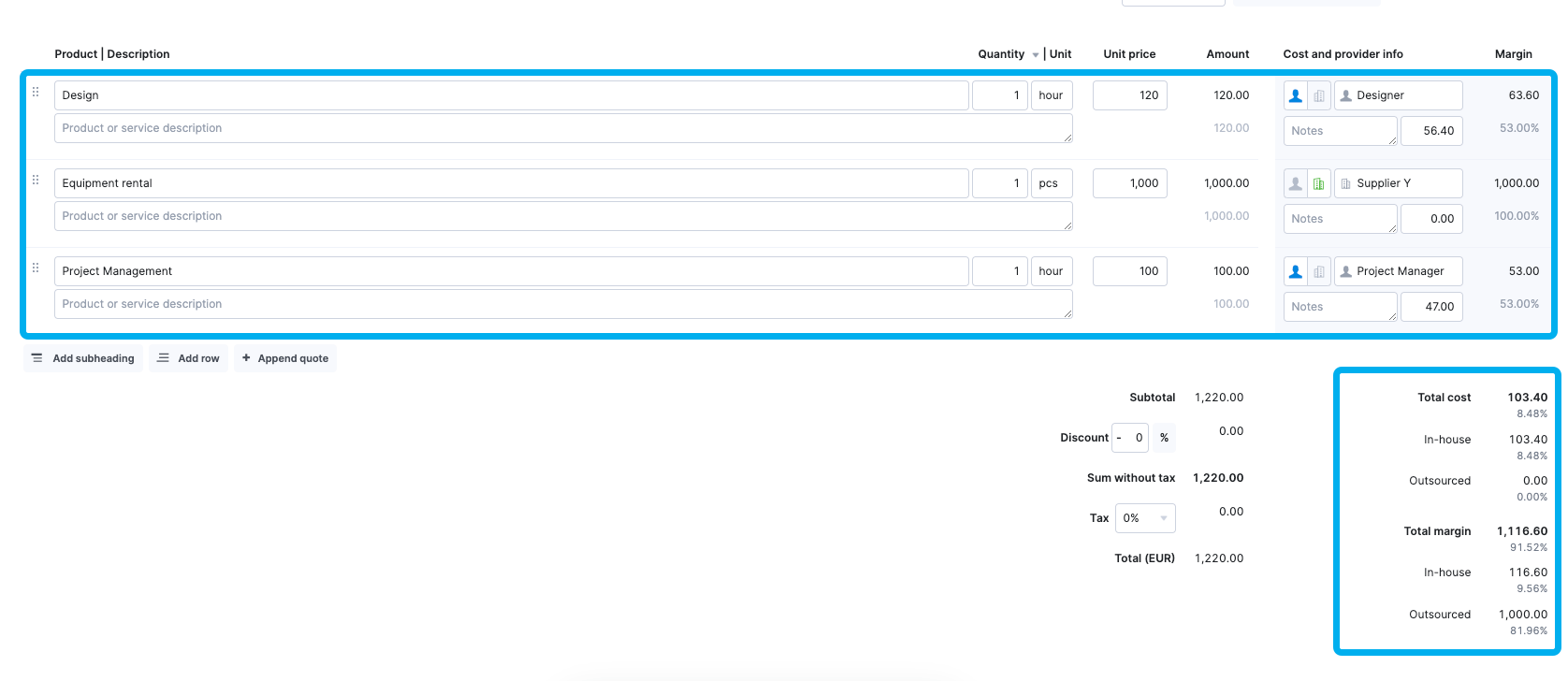

Scoro’s quote builder automatically calculates margins for you. So you can easily see how different prices impact your margins. And can set your pricing according to your profit margin targets.

5. You’re not prioritizing your pipeline

You might think you understand your pipeline.

But if you’re only looking at big-picture numbers like total pipeline revenue, you’re putting your agency’s future revenue and profits at risk.

As Ryan McNamara, Head of Operations at Rise at Seven, notes:

If you’re not tracking value, likelihood, and timing with discipline, you’re not forecasting—you’re guessing. Pipeline drives hiring, cash flow, and confidence. Treat it like a system, not a spreadsheet.

Ignoring the win probability and timing of quotes in your pipeline gives you a skewed understanding of your actual forecasted revenue.

This can quickly result in overspending based on future revenue that isn’t actually confirmed.

Instead:

Create a system for managing your pipeline and review it at least monthly. This includes monitoring probability, timing, and value for new proposals.

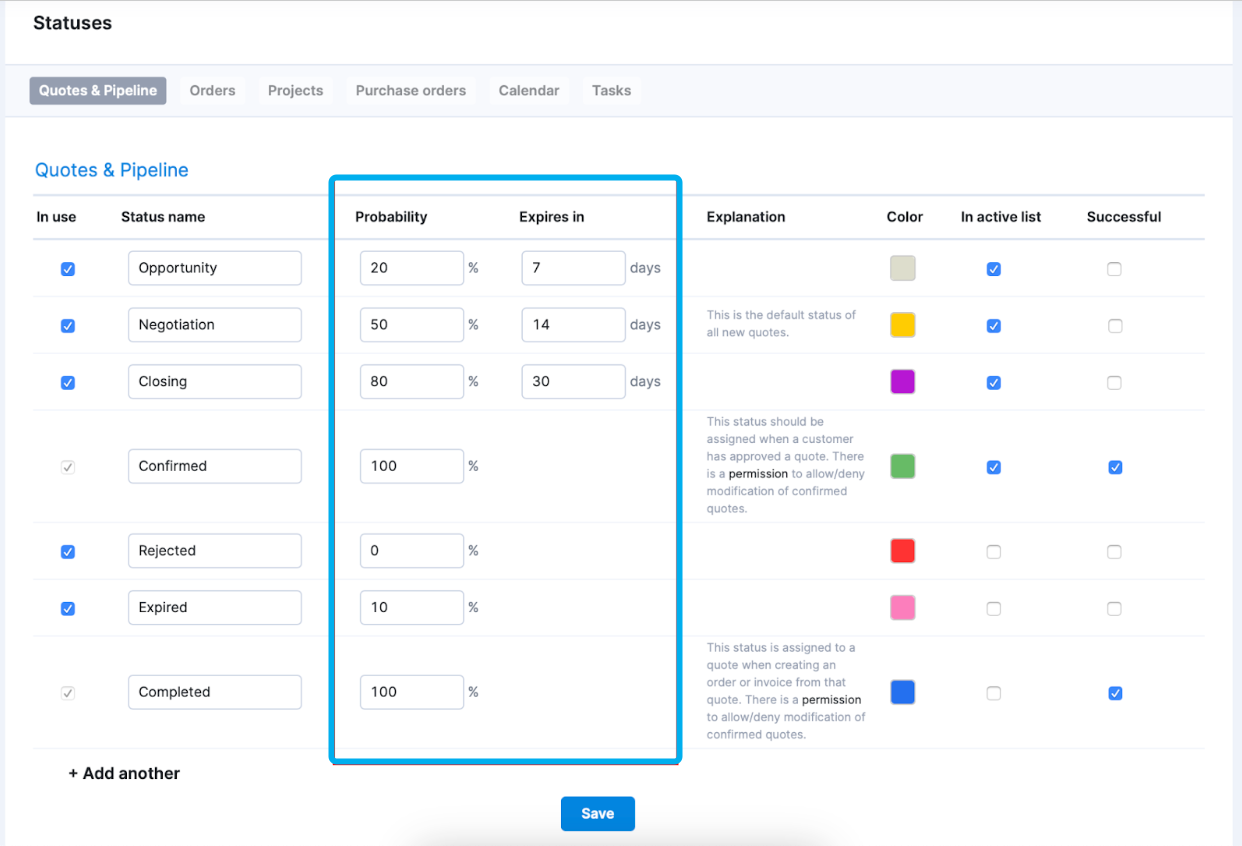

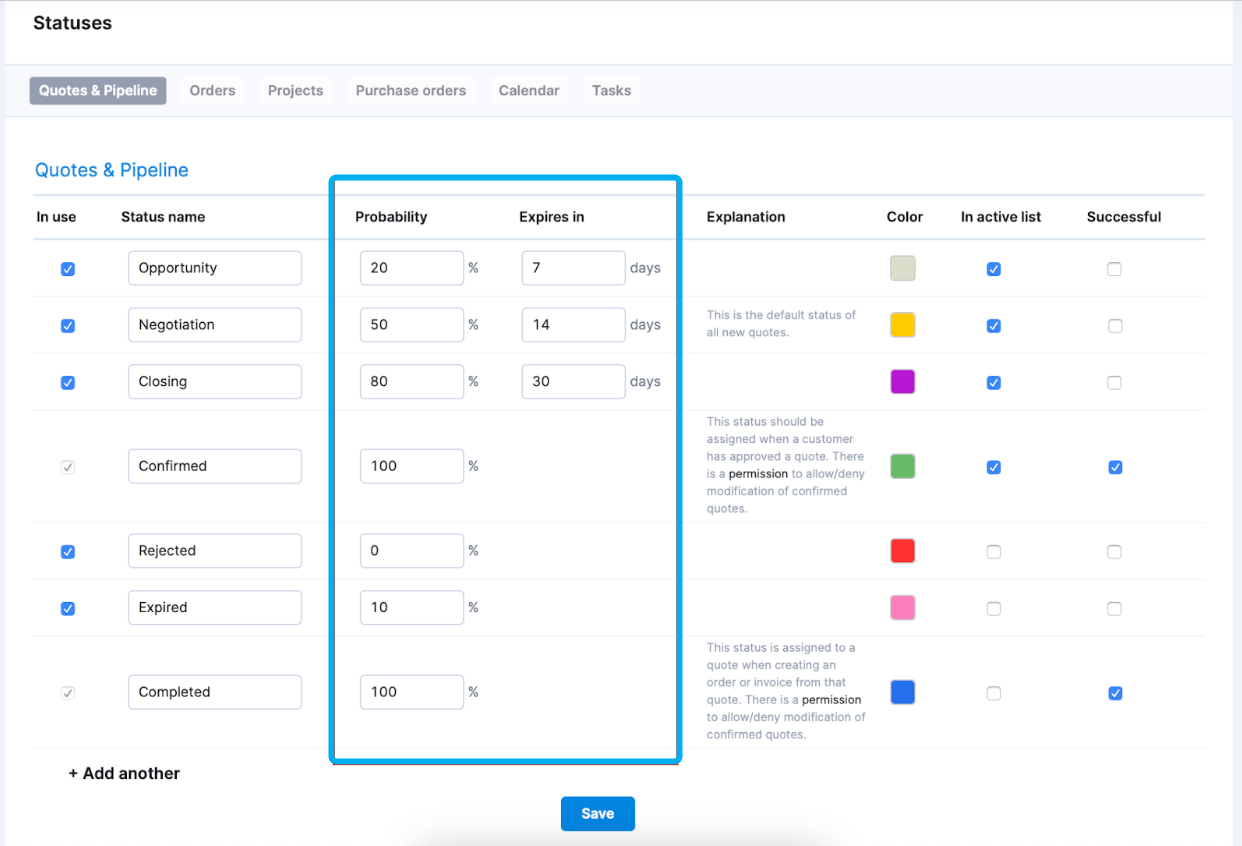

In Scoro, this starts with setting probability. Do this automatically by setting a probability rate based on what stage the proposal is in.

Then, use a weighted pipeline report to analyze your true pipeline value by factoring in timeline and probability.

Scoro’s weighted pipeline report does these calculations automatically for you, so you can get a clear picture of true pipeline value at a glance.

For example, you may have $145,000 in the pipeline, but if those quotes are only 50% likely to close, your true pipeline value is more like $72,000.

And try to review your quarterly proposal win rates, probability, and timing:

Ask yourself questions like:

- How many of your “Opportunities” actually turned into “Proposals”?

- What percentage of “Proposals” really closed?

- How long does it really take for an “Opportunity” to move to “Scoping” or a “Proposal?”

Understanding how likely deals are to close and how long that tends to take helps you make informed decisions about hiring and capacity planning.

So you can make sure you have enough coverage for incoming work while still protecting your margins.

6. You’re regularly overservicing clients

Overservicing happens when you start doing more for a client than what you originally agreed on. Scope creep can start small—an extra meeting here, another round of revisions there.

Small additions like this can support client retention and satisfaction. But taking on this extra work consistently is a big problem.

Why?

Because regularly overservicing squeezes your margins and sets up expectations you can’t easily sustain in the long run. It also leads to:

- Burnout on your team

- Lower-quality, rushed work when dealing with too many unexpected assignments

- Reduced time spent on other clients, potentially increasing client churn

To avoid overservicing:

Track estimated vs. actual hours for each task or project phase to spot overruns.

If you’re at risk of going overtime—or already have—adjust project resources accordingly and check in with your client to make sure you’ll get paid for all work beyond the initial scope.

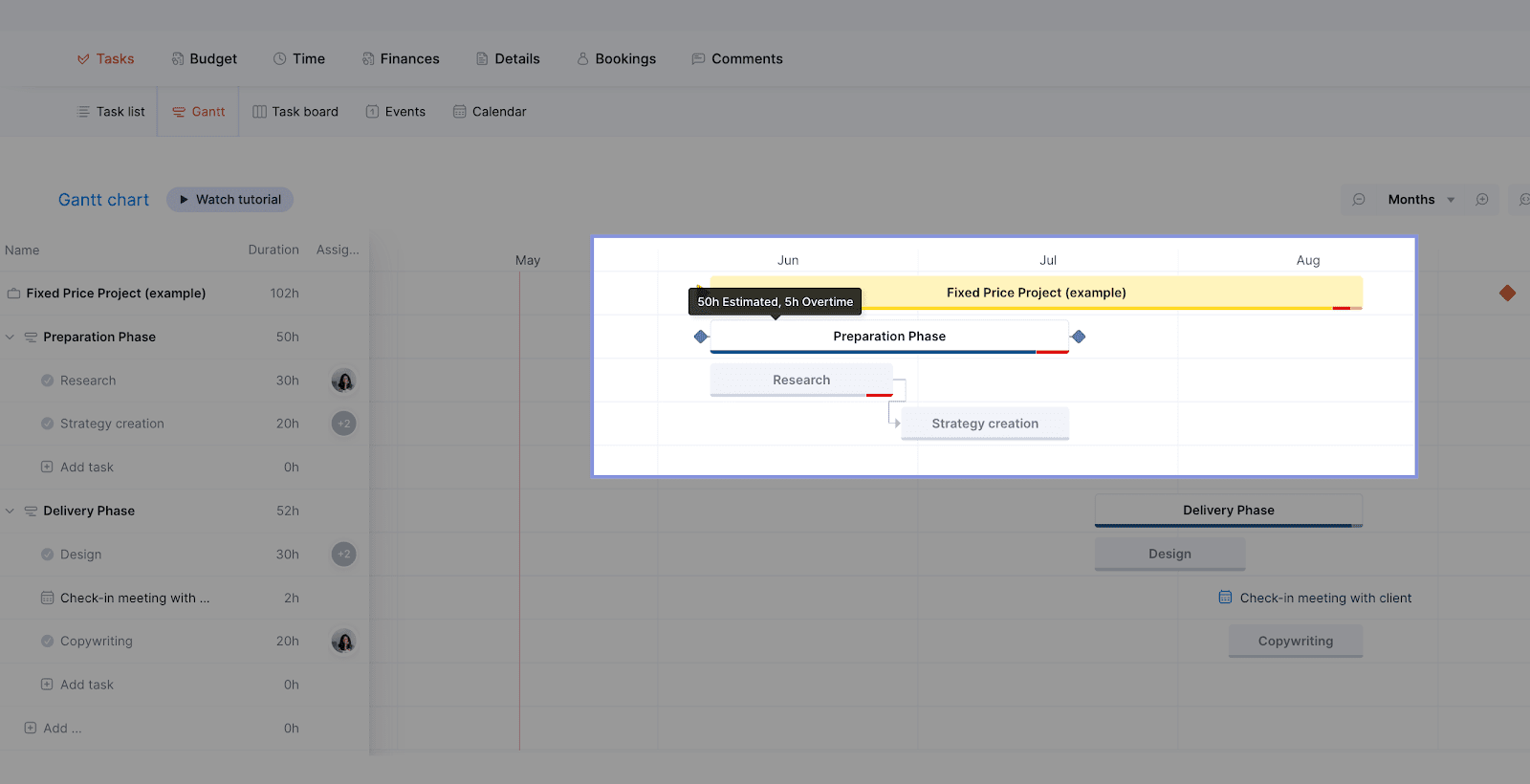

If you’re tracking time in Scoro, use the “Gantt” view to quickly see estimated vs. actual hours for each project task or phase.

And train project managers to use weekly burn reports to monitor scope creep and flag warning signs.

Burn reports show you how fast you’re going through your planned budget and hours.

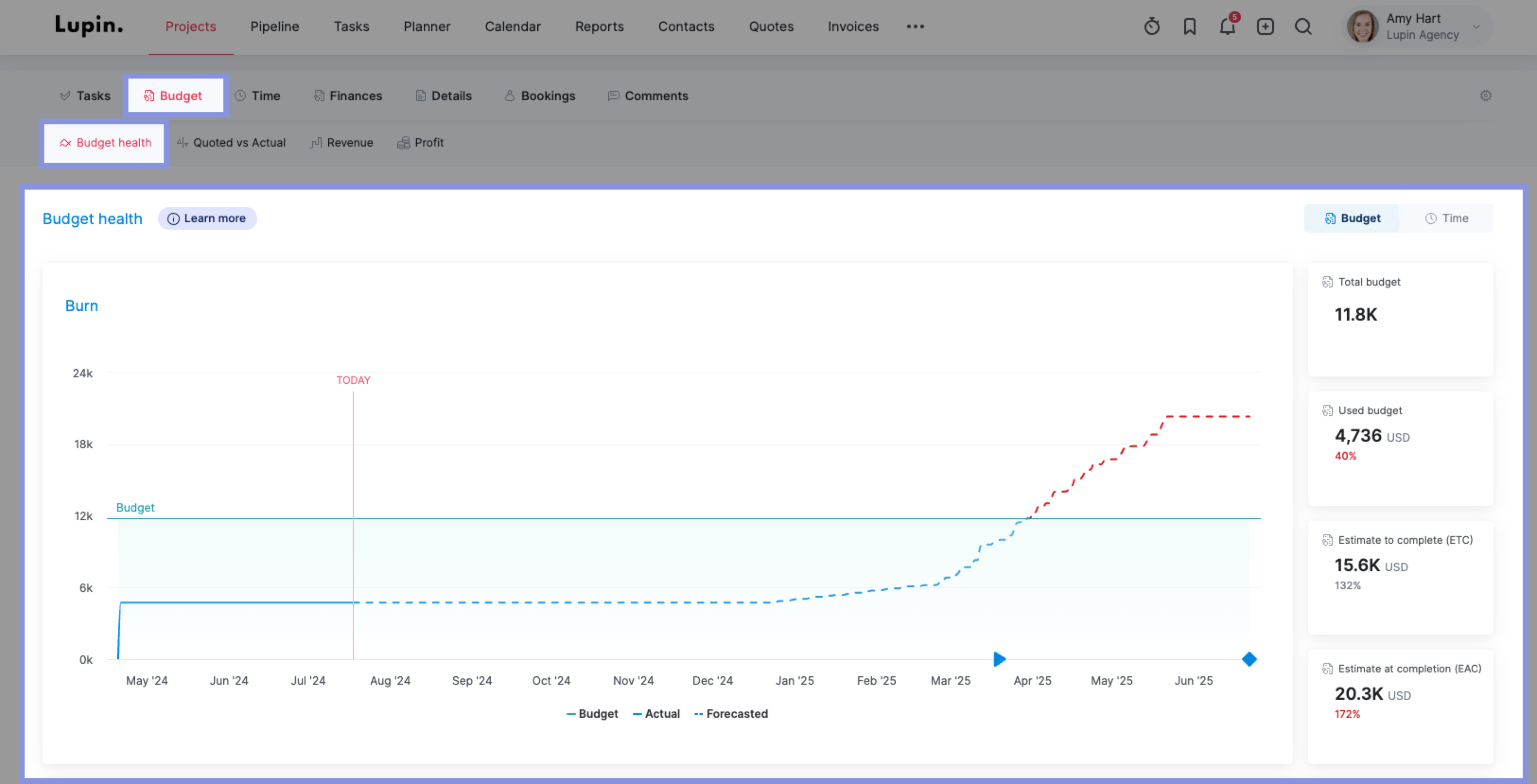

In Scoro, you can also see a forecast for where you’re likely to end up profit-wise based on the remaining work. Find these forecasts under the “Budget” > “Budget health” tabs of any project.

Use this data to course-correct as needed and stop overservicing before it impacts your profits.

Say you’ve already used 50% of your budget but you’re only 30% finished with the project. You may need to switch to lower-cost staff, reduce project hours, or adjust pricing with your client to protect your margins.

And finally, try to implement change orders with clients to improve project cost estimation, document scope creep, and get paid fairly for all completed work.

A change order can be as formal as an updated quote or as informal as an email with a bulleted list.

Either way, make sure to document the expanded scope and the updated pricing to maintain a documented trail of agreed-upon work and pay.

7. You’re missing signs of client churn

“Client churn is often a silent killer for many agencies,” Logan Lyles, Director of Growth at Business Builders, told us.

This is especially true for agencies who have lots of retainer clients with monthly recurring revenue.

A high churn rate—meaning you’re regularly losing retainer clients— creates major instability for your agency’s finances.

Unstable revenue makes it hard to accurately forecast capacity or hiring needs. This often leads to burnout (from under-hiring) or low AGI (from over-staffing).

Logan explained that agencies often accidentally overlook warning signs of churn:

I started to notice that … our team was interpreting clients that weren’t demanding or upset as ‘happy clients,’ which wasn’t necessarily the case. Many of those clients were disengaged and not seeing the value of what we were delivering. When you miss these signals, client churn starts to creep up—and it can spell disaster for your agency if you don’t act swiftly.

“I started to notice that … our team was interpreting clients that weren’t demanding or upset as ‘happy clients,’ which wasn’t necessarily the case. Many of those clients were disengaged and not seeing the value of what we were delivering. When you miss these signals, client churn starts to creep up—and it can spell disaster for your agency if you don’t act swiftly.”

To prevent client churn:

- Start tracking customer churn monthly

- Watch for signs of disengagement or other indicators of churn among your clients

- Implement quarterly reviews with clients to highlight wins, explore future projects and goals, and demonstrate the value of your work together

To track churn in Scoro, use retainer projects to set up scheduled invoices for monthly recurring revenue.

Then, add a monthly recurring revenue (MRR) widget to your dashboard to understand what percentage of your retainer clients are churning and how often.

8. One client accounts for most of your revenue

It can feel amazing to win a major anchor client—a huge deal that may be the largest you’ve ever sold. But relying primarily on one client for most of your revenue is a big risk.

Why?

Because if that client suddenly ends their retainer or work with you, your profitability and AGI can tank overnight. Which can force budget cuts or even layoffs.

As Ben Goodey explains:

Things change quickly and unexpectedly in the agency world. If you’ve built a team to service this client, you’ll quickly flip from profitable to unprofitable … Don’t overgrow your team until your biggest dependency is 20% of revenue/profit coming from one account.

To fix this:

- Set a soft revenue cap of 25% AGI per client. If one client makes up more than a quarter of your revenue, you put yourself at risk if they churn. If you notice your AGI per client approaching this cap, focus on diversifying your client roster (see step #3).

- Set a minimum and maximum engagement size based on your desired AGI.

For example, an agency with an average annual AGI of $2 million might set a minimum engagement size of $100,000. This way, you don’t stretch your team too thin taking projects that don’t significantly contribute to your bottom line.

And in this case, a maximum engagement size of $400,000 (20% of the AGI) would ensure you don’t become over-dependent on any one client.

- Analyze your existing client base and revenue and build out your pipeline to diversify it

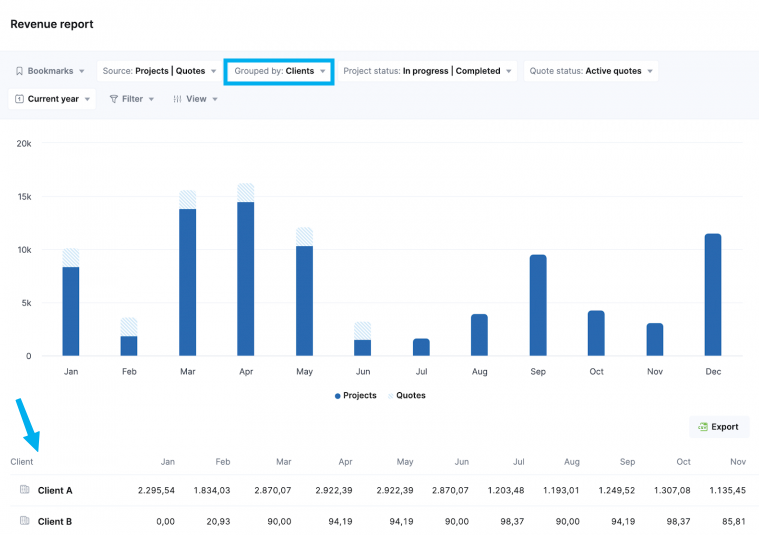

In Scoro, head to “Reports” > Revenue Report.”

And select the “Grouped by: “Clients” filter to see the percentage of your monthly revenue driven by each client.

This way, you can easily see if any one client is dominating your revenue. Aim to review this at least quarterly to ensure a balanced client portfolio.

Final thoughts

Successful agencies don’t wait to react to messy finances. Instead, they build habits that make it easy to spot and fix red flags before they become major problems.

Build your own by:

- Reviewing core financial metrics like AGI per employee, profit margins, billable utilization, burn rate, and MRR every month—not just at year-end

- Reviewing and adjusting pricing regularly whenever there’s signs of underpricing, overservicing, or a lagging pipeline

- Paying attention to past and future financials, like pipeline health, client churn, and revenue forecasts as seriously as current numbers

- Maintaining a balanced client roster and pipeline so no one client or project makes up most of your revenue

All kinds of agencies use Scoro to implement these best practices and strengthen their bottom line.

For instance, creative agency Design de Plume used real-time visibility and reporting in Scoro to improve its profitability by over 20%.

Try Scoro for free today and get the financial insights you need to boost your own profitability and scale your agency.