For successful architecture projects, amazing designs aren’t enough. You also need the right data to execute them.

That’s a lesson Giovanni Scippo, Director at 3D Lines, learned firsthand:

We started tracking KPIs more formally about four years ago, and it completely changed how we quote, schedule, and staff projects. Now, we have real data backing our decisions, which has helped reduce scope creep and last-minute firefighting.

But which metrics should you monitor?

Drawing from expert insights, we’ve compiled 11 top architecture firm performance indicators to focus on—so you can deliver stunning work on time and protect your bottom line.

1. Firm revenue

Firm revenue is the total income your architecture firm earns over a specific time frame (monthly, quarterly, or annually). It includes all fees invoiced to clients for design work, planning, construction administration, and other relevant services.

This fundamental metric is the clearest indicator of whether your firm is growing, staying stable, or facing decline. Tracking it helps you meet your financial targets while covering salaries, overhead, and growth investments.

How to track it

You can track revenue through basic spreadsheets, accounting software, or a combination of both.

A more helpful option is using architectural management software. This type of tool gives you a clearer picture of which clients, project types, and teams bring in the most money.

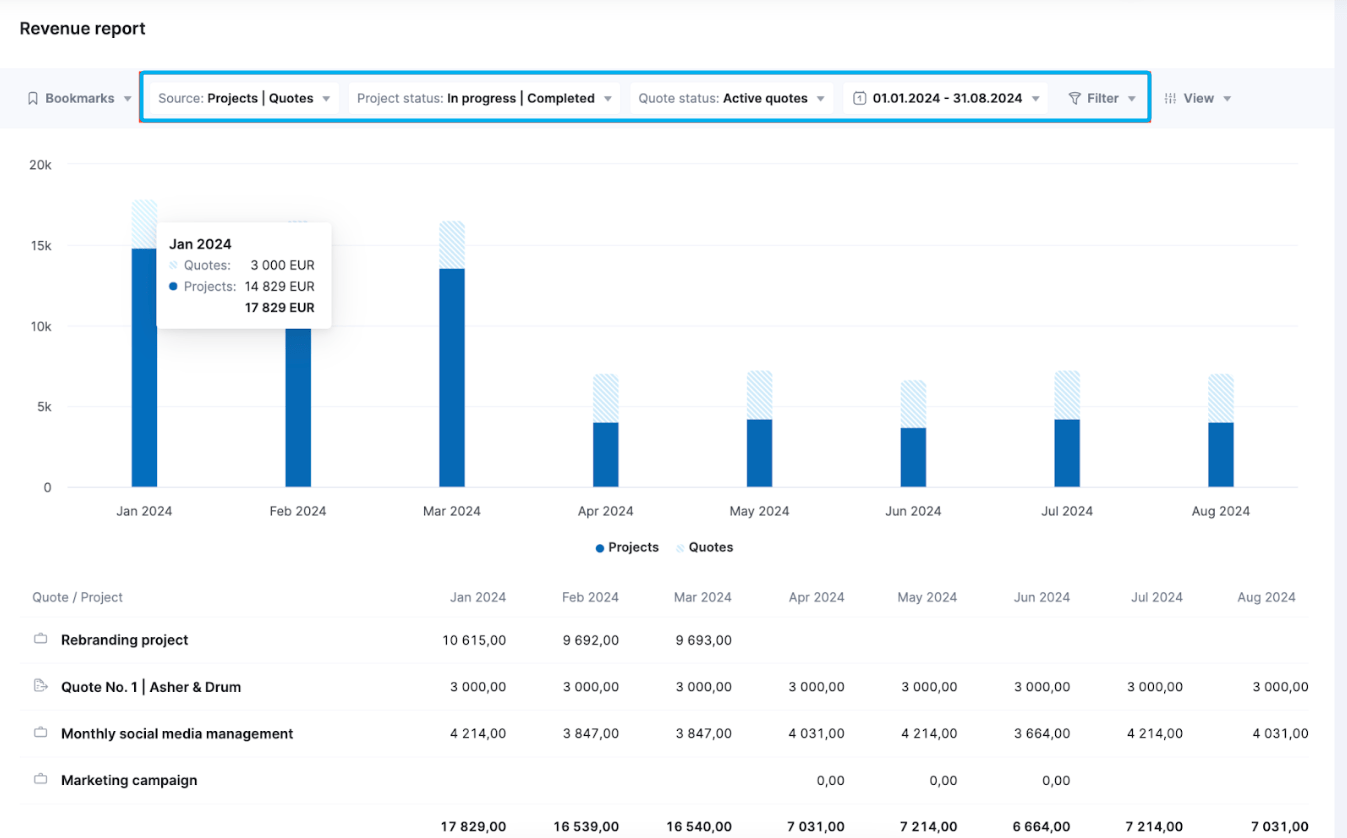

Use Scoro’s real-time “Revenue” report to instantly evaluate your income. The platform automatically updates your revenue based on your quotes and projects. And you can easily filter by project status, quote status, and date range.

2. Work in progress (WIP)

Work in progress (WIP) is essentially all the billable hours and project expenses you’ve accumulated but not invoiced. These are your “in-progress” earnings waiting to become actual revenue.

Tracking your WIP gives you an accurate understanding of upcoming income so you can maintain a healthy cash flow.

If your WIP is too high, that’s a red flag that you’re doing a lot of work without getting paid (time to send those invoices!). But if it’s very low, it could mean you don’t have enough active work in the pipeline—which could lead to future revenue gaps.

How to track it

Many architecture firms monitor WIP through time-tracking systems and project management tools.

Staff log their billable hours and expenses, while managers monitor how much revenue has been “earned” but not yet billed.

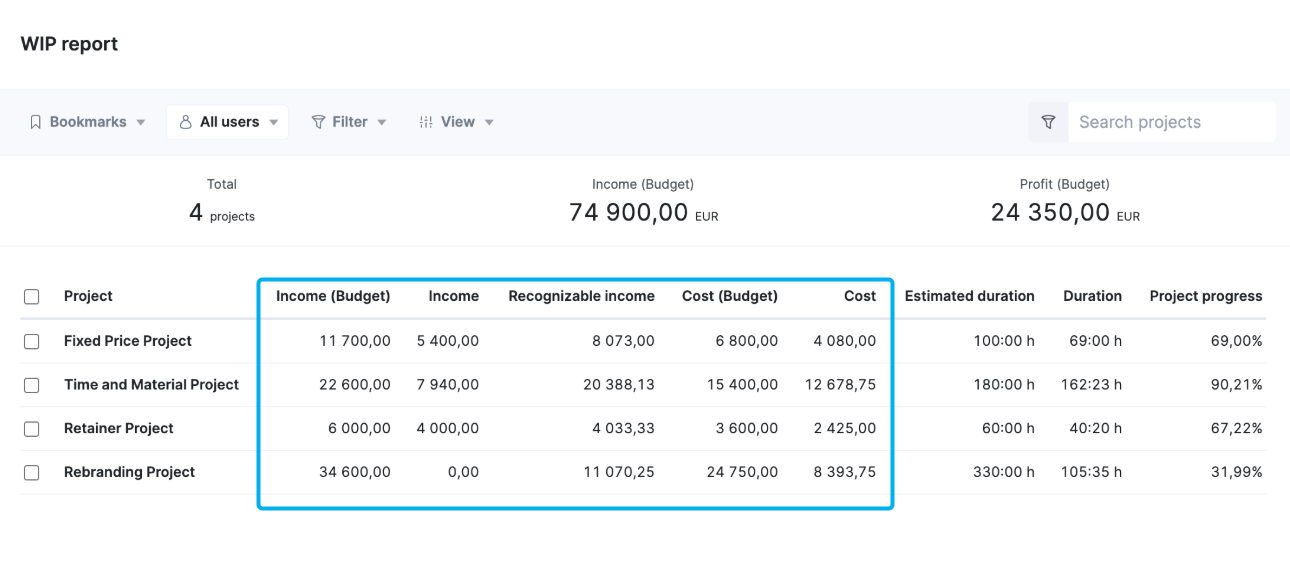

Scoro’s “WIP” report streamlines this process by automatically comparing your planned and actual revenue in real time.

The system looks at your project progress and calculates how much you should’ve billed by that point. So you can quickly address any revenue gaps.

Using the chart, you’ll know when to pick up invoicing when WIP is high, ramp up business development when it’s low, or adjust project timelines as needed to protect your cash flow and profitability.

Further reading: Revenue Recognition: A Guide for Service Firms

3. Accounts receivable (AR)

Accounts receivable (AR) is how much money clients still owe your firm for completed work. Basically, it’s all the invoices that still haven’t been paid.

If you’re consistently waiting longer than a month to get paid, your firm might struggle to cover its bills and salaries on time.

A healthy AR collection period is within 30 days, which ensures steady cash flow and keeps the business running smoothly.

How to track it

Your accounting tool probably has an AR “aging” report or dashboard that shows each invoice’s status (current, 30 days overdue, etc.) and the average days to payment.

Typically, someone in finance reviews these reports and sends payment reminders for overdue invoices.

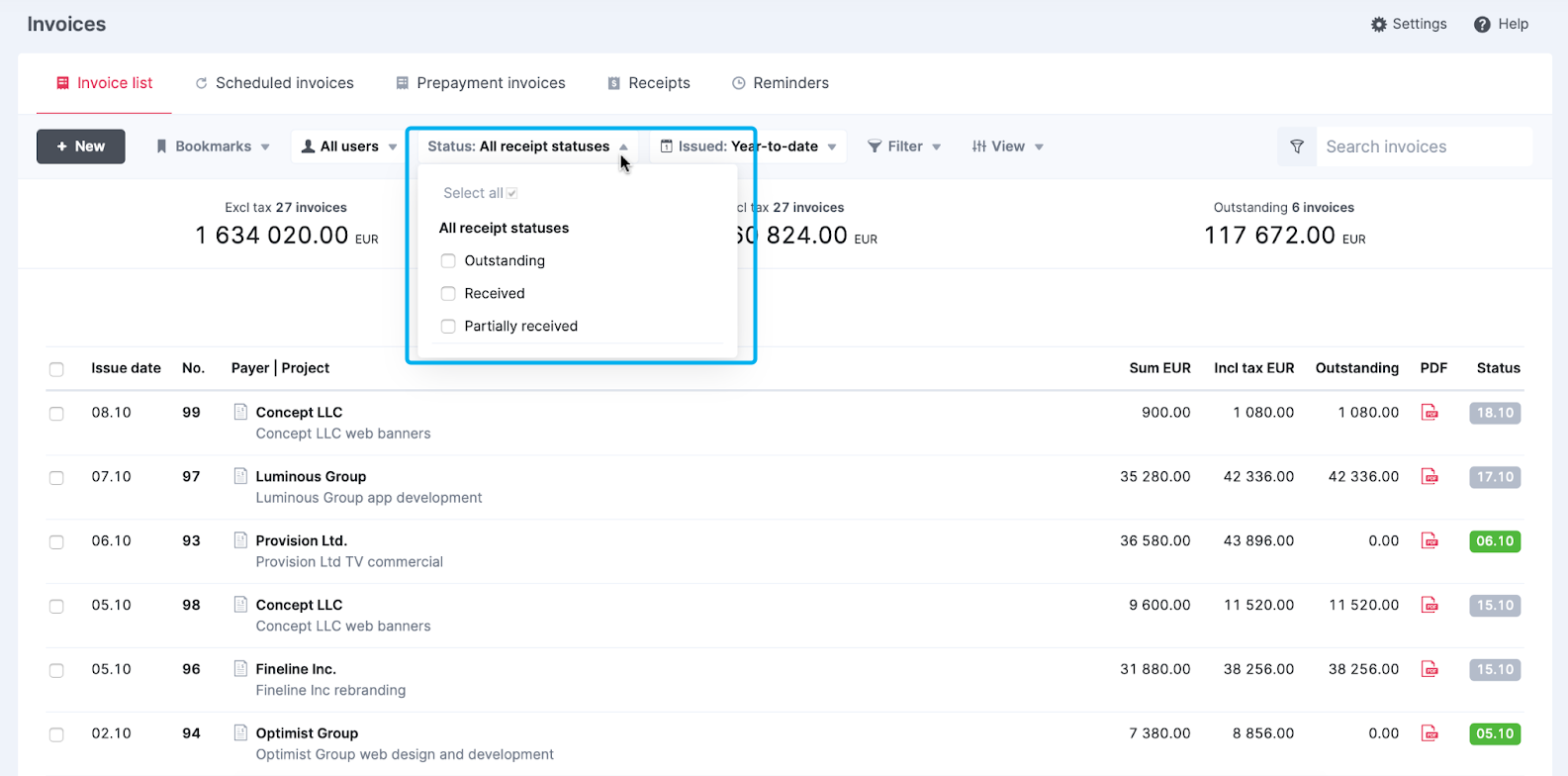

Scoro streamlines this by providing real-time visibility to your entire management team—not just accountants—so project managers can follow up directly with clients.

The platform displays outstanding invoices on the ”Invoices” list view:

Top Tip

Set up automated invoicing reminders in Scoro. Add reminders before the invoice is due and then 10 and 15 days after the due date. This way, you can save time hunting down payments—and, hopefully, get paid faster.

4. Cash flow

Cash flow is the net amount of cash moving into and out of a business over a given period.

It measures how much actual money your firm has on hand after accounting for all income and expenses.

Positive cash flow means you brought in more money than you spent. And negative cash flow means you spent more money than you received.

Accurately forecasting cash flow is critical. As Simplifi Real Estate CEO Devin Ramos notes:

Cash flow forecast accuracy has been a game-changer. We can now take on 30% more projects with the same working capital.

Besides helping you manage your project pipeline well, cash flow forecasting ensures you have enough money to cover salaries, rent, and supplier costs—even when waiting for certain projects to bring in revenue.

How to track it

Most firms review a monthly cash flow forecast and actual cash movement through accounting software like Quickbooks, Xero, or Sage.

Scoro connects with these tools to create a single source of truth, keeping your invoice and expense data updated and helping you spot any red flags before they impact the business.

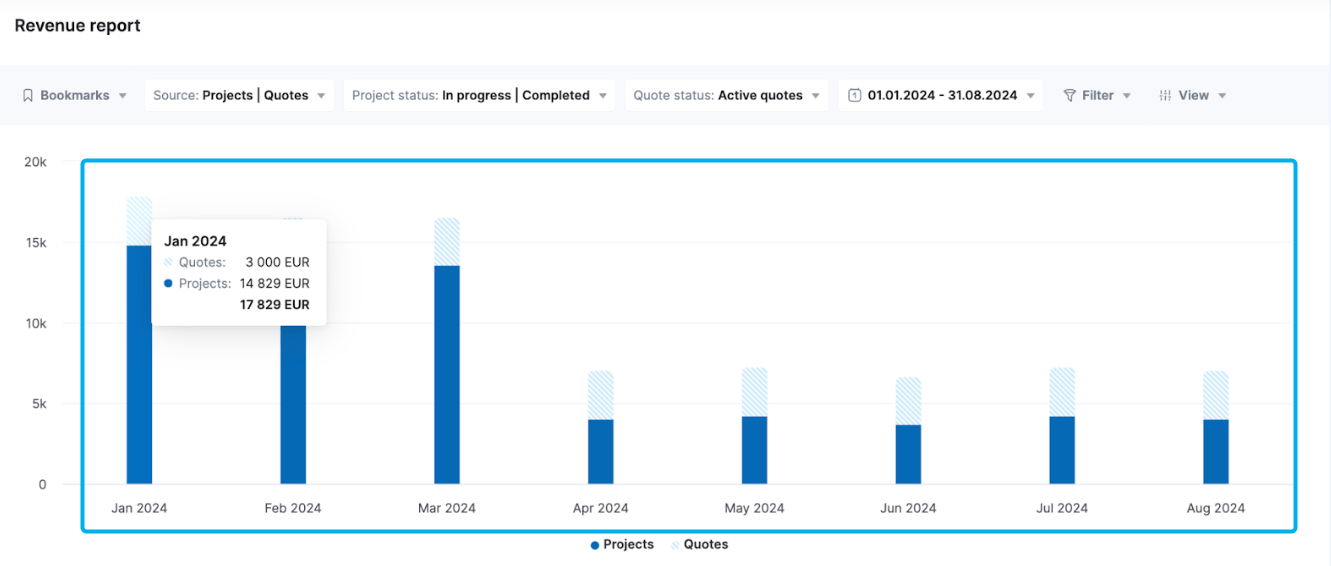

For example, use the “revenue” report to see how much income your firm is set to generate over the next month, quarter, or year. It updates automatically based on your projects and quotes, and shows you confirmed projects (solid dark blue) and tentative work (striped, light blue):

5. Backlog

Backlog refers to the total value of contracted work your firm has committed to but hasn’t completed yet.

While it’s usually measured in terms of revenue, many firms also measure their backlogs in time.

For example, “eight months of backlog” means the backlog revenue equals about eight months’ worth of the firm’s average revenue.

A healthy backlog means you have enough work (and income) lined up to keep your team busy and cover costs for the foreseeable future.

If your backlog gets too low, it’s a sign to ramp up business development efforts before your cash flow stops.

On the flip side, too large of a backlog can also lead to problems. You risk burning out your team and disappointing clients with delayed or late work.

How to track it

Architecture firms can track backlog by reviewing all upcoming projects that haven’t been completed yet.

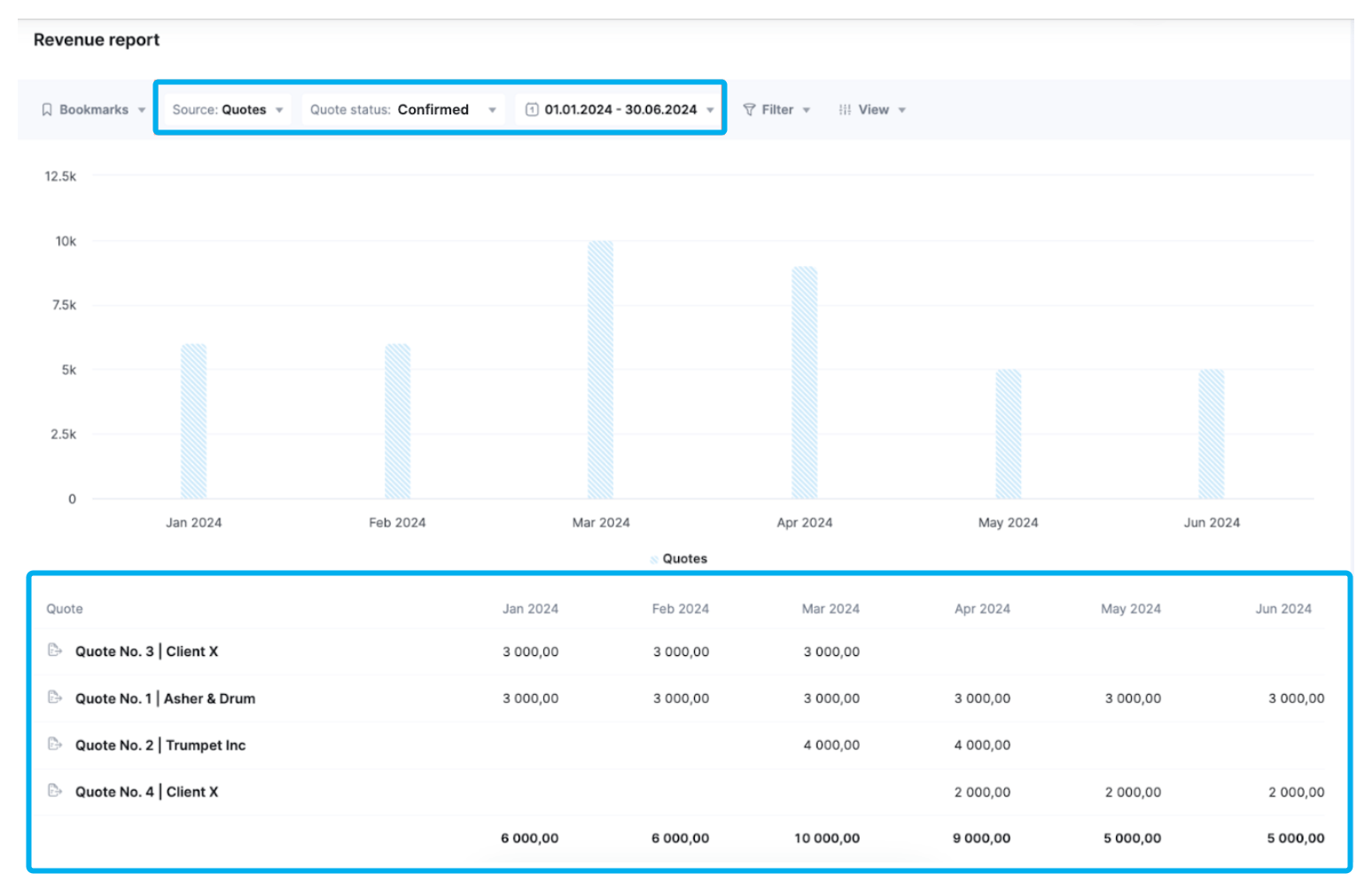

In Scoro, one effective way to monitor backlog is through the “Revenue report,” filtered by “Source: Quotes” and “Status: Confirmed.”

This view gives you a forward-looking picture of confirmed work that’s been sold but not yet completed—your revenue backlog.

Confirmed quotes are broken down by month, showing how much revenue is already committed.

This helps your firm answer key questions like:

- Do we have enough work lined up to keep the team busy?

- When might we hit a gap in revenue?

- Are we overcommitted in any future month?

6. External contractor fees

External contractor fees are fees you pay to any outside specialists.

For architecture firms, this includes structural engineers, mechanical, electrical and plumbing (MEP) engineers, surveyors, freelance designers, and other consultants.

If consultant costs run higher than budgeted, your project’s margin shrinks accordingly. Plus, you often need to pay contractors before you’ve gotten paid, which can lead to cash flow disruptions if you aren’t paying close attention to costs.

By closely monitoring freelancer and contractor expenses, we balance quality with profitability and ensure we’re not overspending on outsourced tasks that could be streamlined in-house,” Giovanni adds. “It’s key for forecasting and maintaining margins.

How to track it

One way to track these costs is by logging all invoices from consultants against the relevant projects in your accounting or project management system.

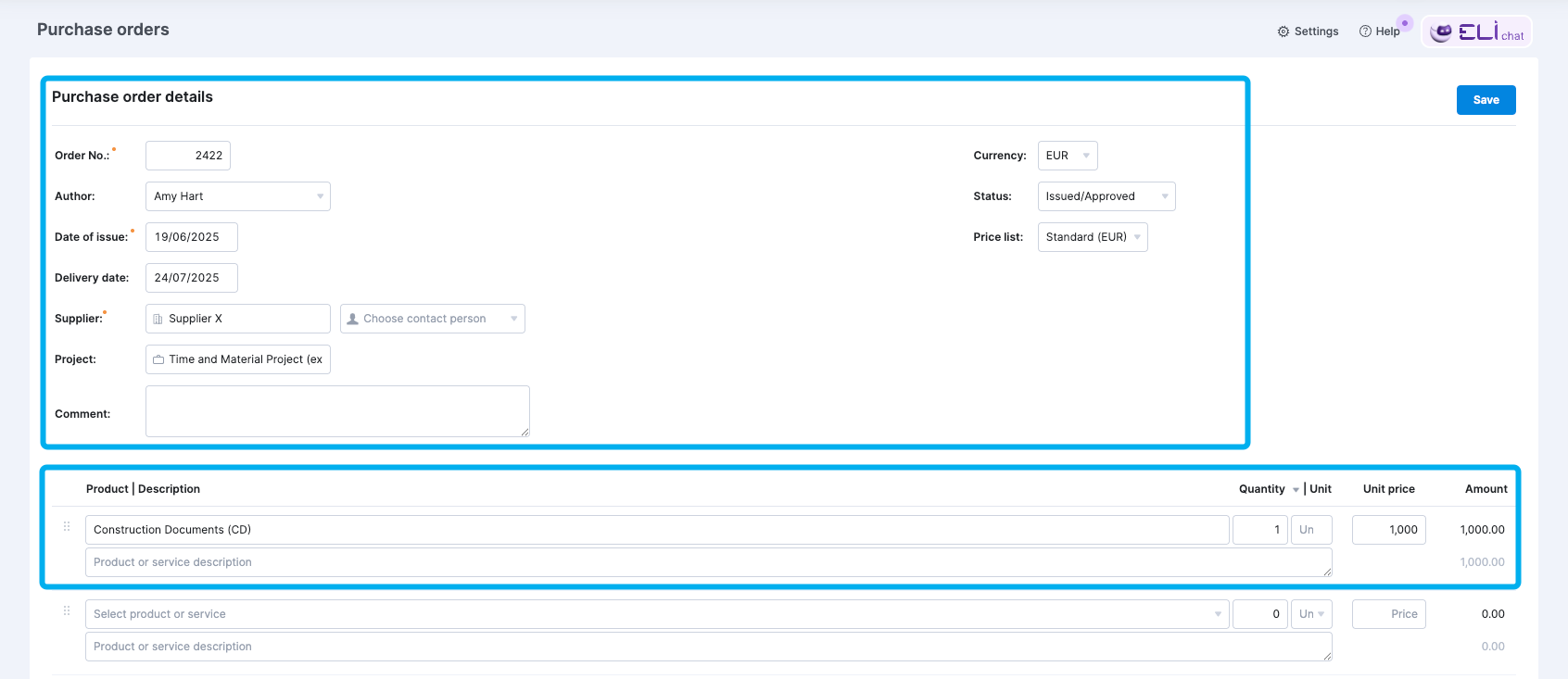

In Scoro, you can manage this in a few simple steps:

- Create a “Purchase Order” to document the agreed cost and scope with the supplier

- Once the work is complete and you’ve received an invoice, convert the purchase order into a Bill

- Alternatively, add expenses directly to the project to capture ad hoc or one-off costs

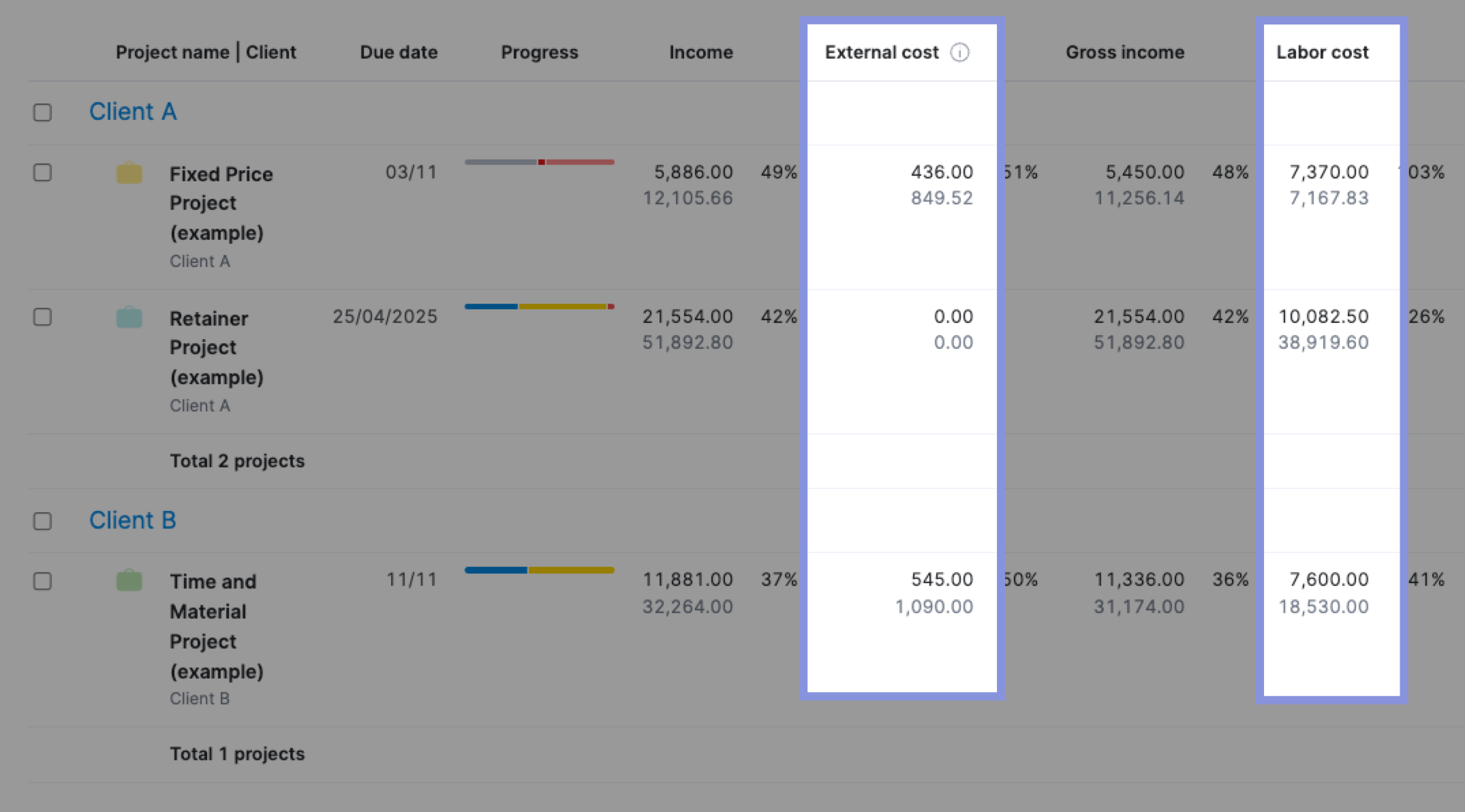

Then, use the “Project list” view to view external costs for your projects (and compare them with internal labor costs):

im

7. Project profitability

Project profitability examines how lucrative your individual projects and overall portfolio are. This critical metric looks at the relationship between revenue and costs, showing you the net profit or average margin across your work.

“The KPI I check most often is project profitability by phase,” shares Mark Sanchez of Florida-based real estate platform Gator Rated. “Breaking down margins at each major milestone keeps surprises to a minimum.”

Closely monitoring project profitability helps you catch issues before they ruin your bottom line.

We began tracking these granular phases after a multi-home renovation overran its timeline and budget, despite looking fine on paper. Now, we can pinpoint whether delays are coming from early design, permitting, or field execution and course-correct immediately.

How to track it

For calculating project profitability, you have two options:

1. Add up all your project-related costs (staff labor, consultant fees, expenses) and compare them with project revenue using this formula:

Project profit margin = (Revenue – Total costs) / Revenue x 100%

This typically requires pulling data from time tracking, expense management, and billing systems.

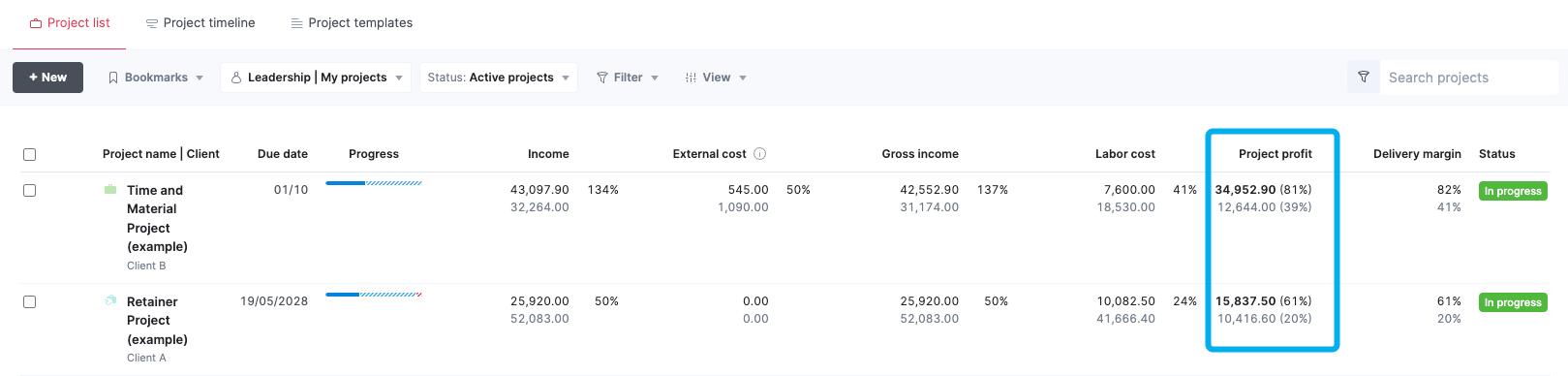

2. Use the “Project list” view, where you can instantly see each project’s revenue, costs, and calculated profit.

The “Project profit” column shows both the monetary value and margin percentage—so you can spot underperforming projects at a glance and course-correct before it’s too late.

8. Billable utilization rate

Billable utilization rate is the percentage of an employee’s available working time that’s spent on revenue-generating work.

The formula is simple:

Billable utilization rate = Billable hours / total hours worked x 100

For example, if someone works 40 hours in a week and 30 of those hours are spent on billable tasks, their billable utilization is 75% (30 ÷ 40 × 100).

High utilization generally means higher profitability, while low utilization signals missed project opportunities or too much time dedicated to admin and other non-billable activities.

“We track utilization aggressively,” Giovanni notes. “Our sweet spot is 75–85%, which leaves room for training, R&D, or short-notice jobs without pushing the team into burnout.”

How to track it

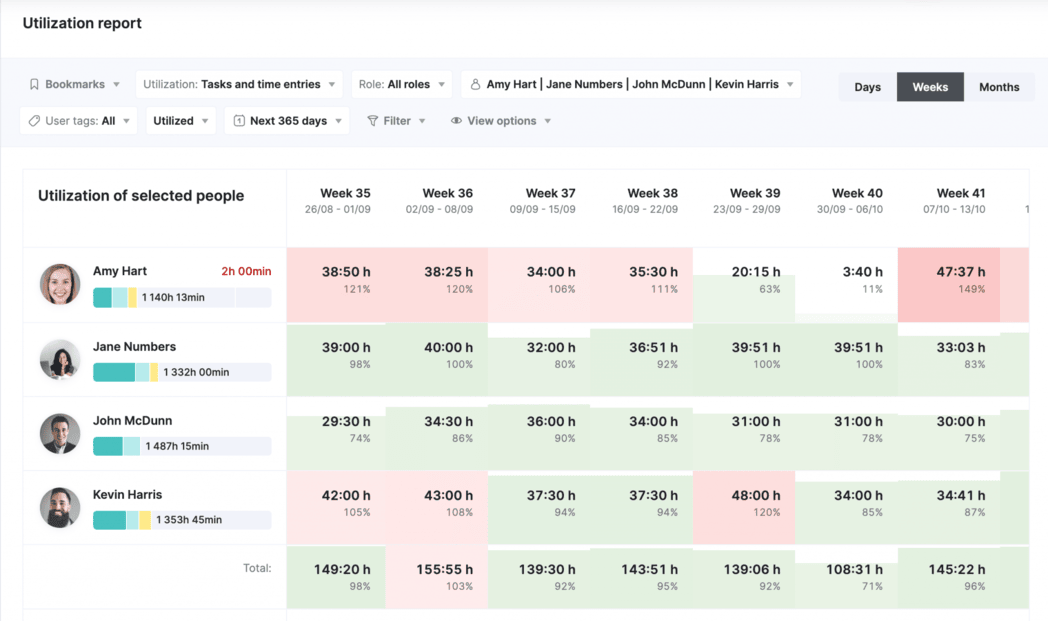

Scoro offers easy, flexible ways for employees to log their time. Then, this information feeds into Scoro’s ”Utilization” report, giving you a real-time look at your team’s billable hours and utilization rates.

Overbooked employees (over 100%) show up in red so you can take action to rebalance their workloads. Green means your employees have an appropriate amount of work, and white means utilization is low.

9. Proposal win rate

Your proposal win rate (or hit rate) is the percentage of project proposals or bids that your architecture firm successfully converts into actual projects.

The calculation is simple:

Proposal win rate = Number of wins / total number of proposals submitted x 100

For example, if you submitted 10 proposals and won four of them, your win rate is 40% (4 ÷ 10 × 100).

“A 30–40% win rate is a healthy benchmark,” Giovanni says. “It’s not always about volume. Sometimes, one well-aligned client is better than three price shoppers.”

A win rate that’s too high might mean you’re not vetting clients properly, potentially leading to burnout and financial issues from bad-fit or low-value work.

That said, a low win rate is also a problem. It means you need to reevaluate your pricing and pitch strategies to make sure you can bring in enough revenue to sustain the business.

How to track it

Firms typically log each proposal in a CRM or sales pipeline tool, marking whether it was won or lost (and why).

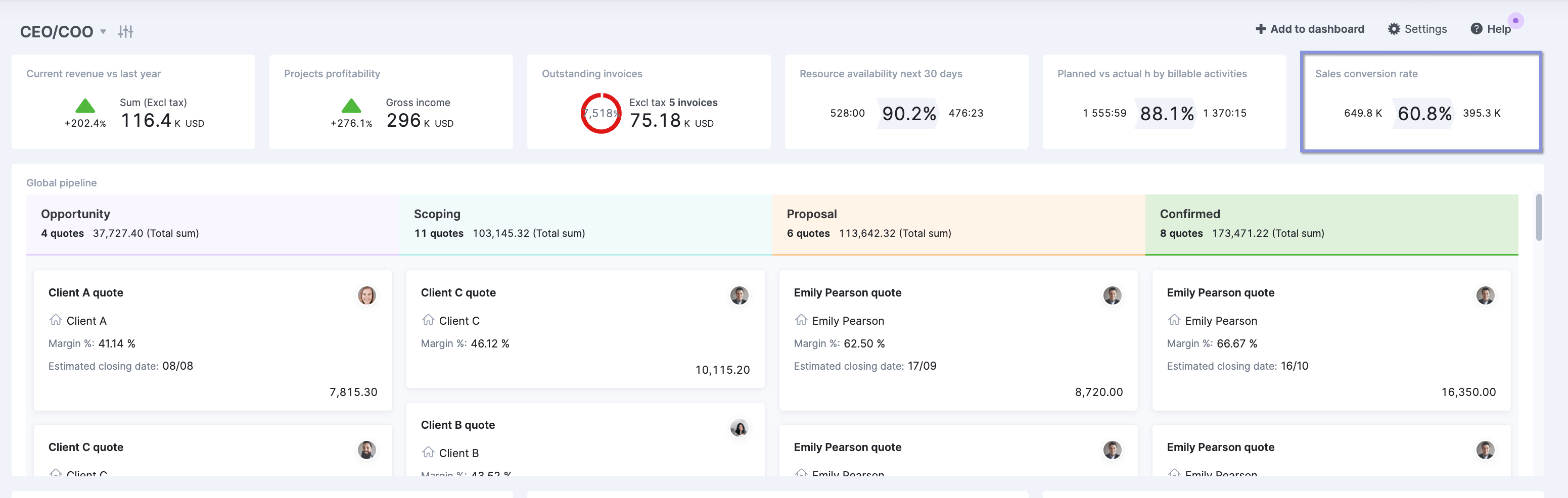

With Scoro’s built-in CRM, you can manage your sales pipeline and see your proposal win rate (and other CRM data) right on the dashboard:

10. Pipeline value

Pipeline value measures all the unconfirmed deals you’re working on and their potential revenue.

For example, “We have five proposals pending, totaling $2 million.”

Your pipeline value is essential for forecasting workloads and cash flow.

A full pipeline with high-value, pending proposals is a promising sign of future revenue. But a low-value pipeline means you need to boost business development or face future revenue gaps and potential staff downtime when current projects wrap up.

How to track it

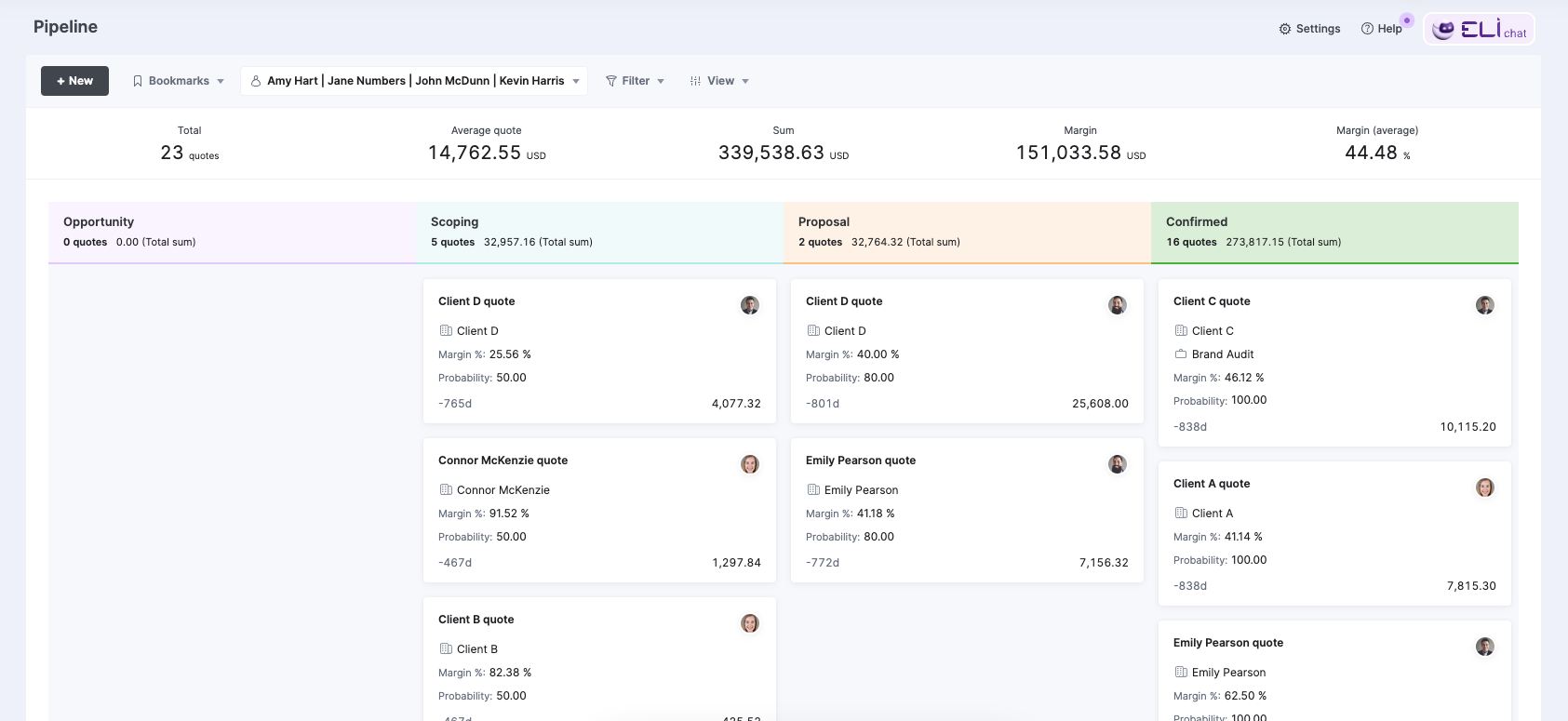

Use Scoro’s “Pipeline” dashboard to view all open deals and their values. Filter pending proposals by stage, size, or projected close date, giving you full visibility into future work—all without looking at spreadsheets.

11. Budget adherence

Budget adherence measures how well your projects stay within their planned cost limits. It shows the difference between estimated and actual costs (either as a percentage or dollar amount).

Managing a budget is key for maintaining healthy profit margins, especially on fixed-fee projects where cost overruns directly reduce profitability.

Frequent budget overruns spell trouble for your firm. And suggest issues in how your firm estimates or manages projects.

How to track it

Log all project-related costs against the budget and review this information weekly. This way, you can catch and address variances before they drain your whole budget.

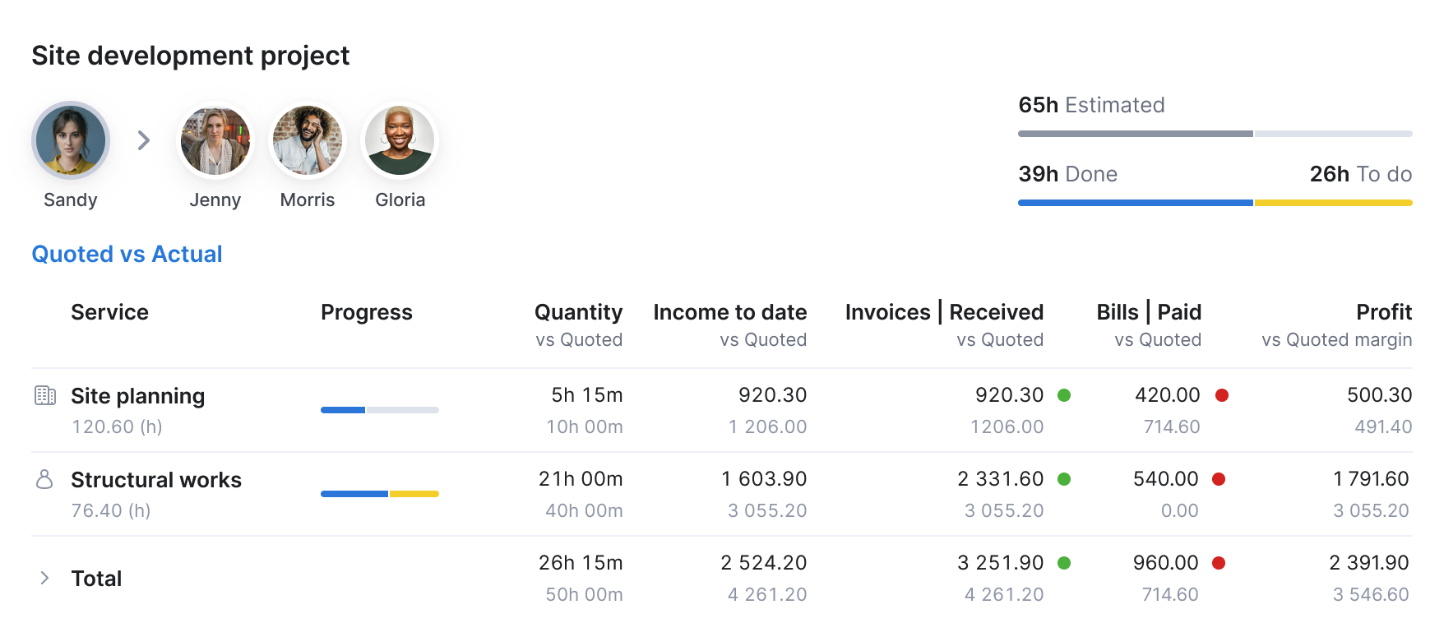

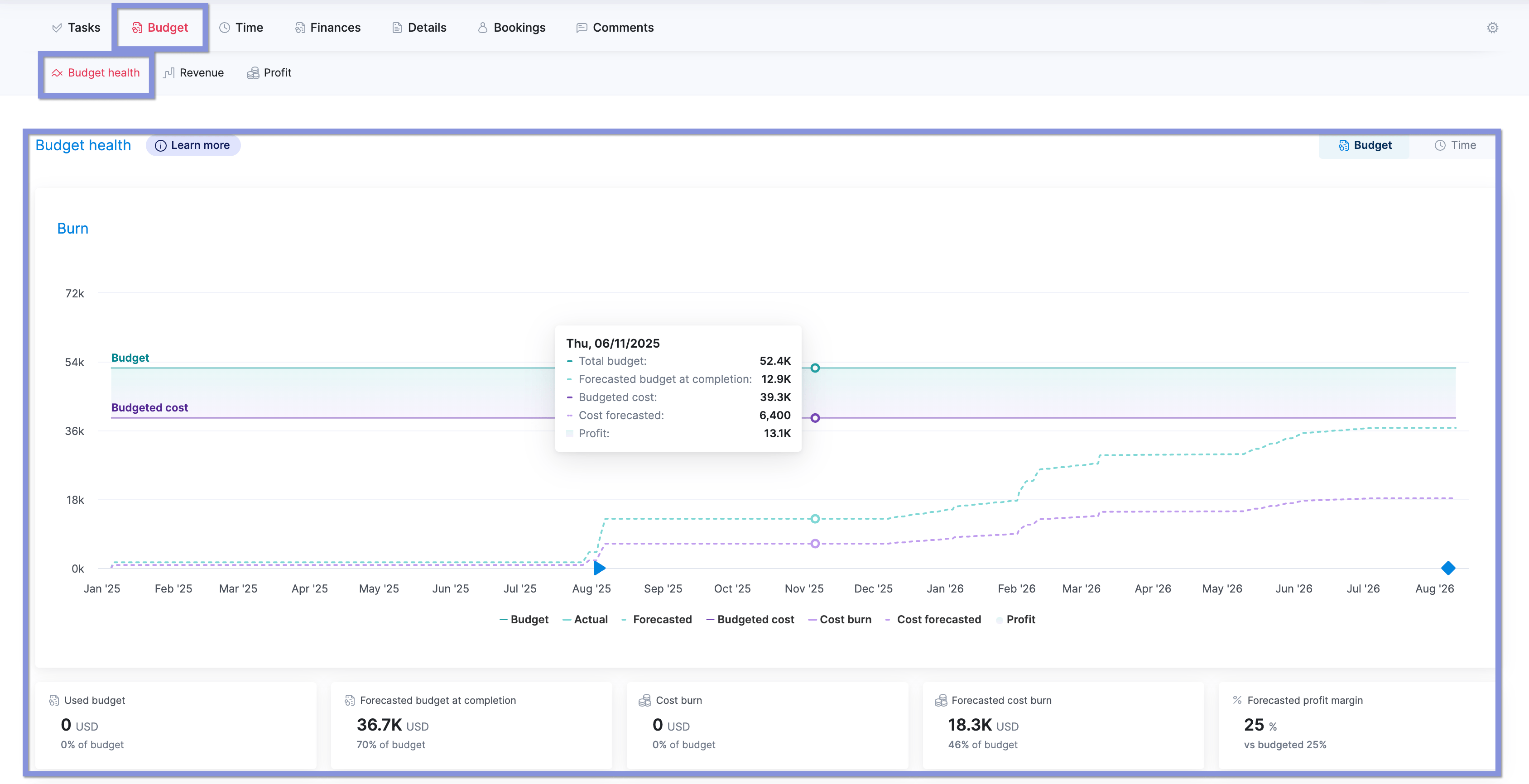

Scoro offers real-time budget health monitoring. The “Quoted vs. Actual” table shows exactly where overruns are occurring:

Plus, the “Budget health” chart uses your project progress and spending to predict whether you’ll finish within budget, giving you time to adjust before it’s too late.

Top Tip

For Devin’s team, 78% of their budget overruns came from “inadequately documented change requests.” Prevent this costly scope creep by establishing a formal change request process. This ensures you approve and price all additional work before you start, protecting your project margins.

Track and improve your architecture firm KPIs

Tracking these architecture KPIs gives you full visibility into your firm’s financial health, project performance, and staff utilization. So you can keep your bottom line strong and clients happy.

Scoro’s all-in-one platform makes it easy to monitor all your key data in one spot, eliminating scattered spreadsheets and extra (expensive) tools.

“We spent four or five hours generating reports for weekly meetings, but now it’s done in minutes with Scoro,” shares Monica Fernandez, COO at Mallol Arquitectos, the largest architecture firm in Central America. Read their story.

Ready to help your firm grow with better architecture KPI tracking? Try Scoro for free for 14 days.