Project accounting means tracking financial data for each individual project.

It’s essential for professional services firms running multiple client projects—like agencies, consulting companies, and architecture and engineering firms—where each project has unique scopes, timelines, and pricing models.

Accurate project accounting involves monitoring your:

- Internal labor costs, based on hours worked and labor rates

- External vendor costs, including contractors, tools, and other third-party services

This way, you can quickly determine whether you’re on track to still meet your revenue and profit margin targets.

Project accounting vs. financial accounting

Project accounting zooms in on the financial performance of individual projects. Financial accounting zooms out to show your company’s overall financial health.

Together, these methods help departments protect profitability and make more informed decisions that support sustainable business growth.

Here’s how they compare:

| Project accounting | Financial accounting | |

|---|---|---|

| Scope | Focuses on specific projects | Focuses on the entire company |

| Timeline | Temporary, follows the project lifecycle | Continuous, follows fiscal years |

| Reporting | Tracks budget, costs, and revenue per project | Tracks company-wide profit and loss |

| Used by | Project managers and finance teams | Finance departments and auditors |

The benefits of accurate project accounting

Accurate project management accounting shows you what each project costs and earns at every stage.

So there’s no guesswork on profitability—you’re monitoring costs, hours, and scope changes in real time.

Using a clear project accounting system also:

- Ensures projects stay within budget: By tracking your project burn rate, you can quickly tell if you’re headed for financial trouble and if you need to adjust your spending to stay aligned with the original estimate.

- Provides real-time visibility into financial performance: Monitoring project accounting data like labor hours, billable vs. non-billable work, and vendor invoices helps you take action to protect your profitability before it’s too late. Like rebalancing workloads or billing out-of-scope tasks.

- Helps you determine which projects are (and aren’t) profitable: Compare revenue, labor costs, vendor expenses, and delivery margins across projects to pinpoint your most and least valuable work. This way, you can prioritize projects, clients, and types of services to better align with your financial goals.

- Ensures client billing is accurate and prevents disputes: Every invoice is backed by logged hours, cost breakdowns, and clear scope info. That transparency reduces billing errors, ensures no billable work is accidentally left out—which can quietly chip away at your revenue and margins—and gives clients confidence in your process.

A 5-step project accounting process for profitable work

To make project management accounting work, you need a clear system that ties estimates, costs, revenue, and reporting together.

Use these five steps to track financial data with precision and keep projects profitable from start to finish:

Step 1: Create a budget estimating process

Accurate project accounting begins with a clear, well-informed cost projection.

Without one, you’re setting prices without knowing whether your margins will hold.

Start by identifying all internal and external expenses—not just the obvious ones like design or development.

A detailed budget helps you avoid pricing too high or too low, ensuring profitability while remaining competitive.

Break costs down into two main categories:

- Internal costs: Multiply each team member’s (or role’s) estimated hours by their unique labor rate (based on job title/seniority level). Then, add them up to get your total internal cost.

- External costs: Add up your out-of-pocket expenses like freelancers, other vendors, software, travel, subscriptions, and tools.

Here’s an example:

| Task | Role | Hours | Internal rate | Internal cost |

|---|---|---|---|---|

| Discovery Workshop | Strateg Expert | 8 | $120/hr | $960 |

| Visual Design | Senior Designer | 20 | $70/hr | $1,400 |

| Project Management | Project Manager | 10 | $90/hr | $900 |

| Freelancer Illustration | External Vendor | – | – | $500 |

| Software License (Figma) | External Tool | – | – | $100 |

- Total internal cost: $3,260

- Total external cost: $600

- Total estimated cost: $3,860

To improve accuracy, base your cost estimates on historical project data.

Look at past work with similar scopes—how many hours did it actually take?

Were there any overlooked costs or scope creep that you should factor in? Then, use those insights to shape your estimate.

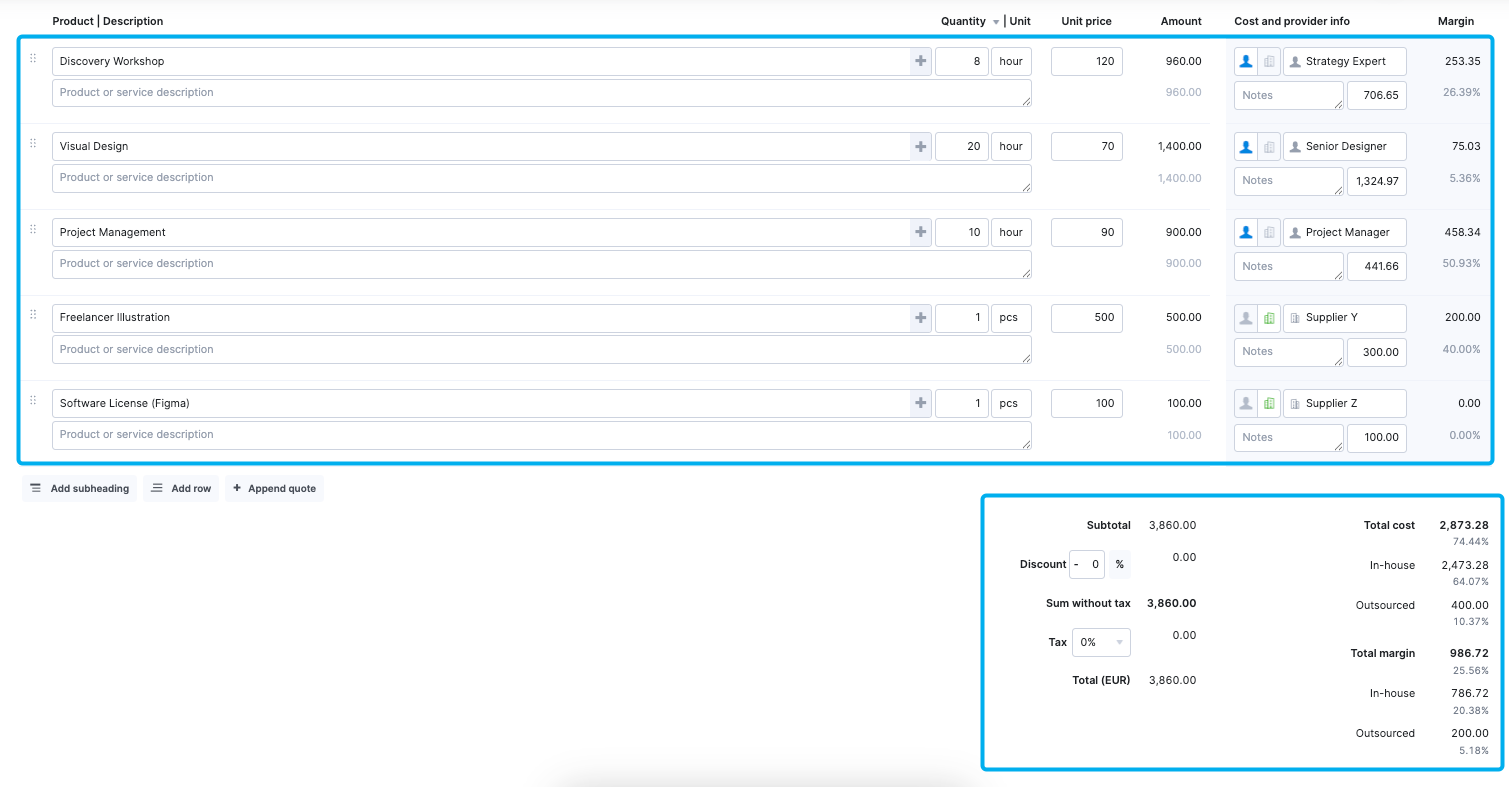

Speed up putting your estimate together using Scoro’s “Quote builder.”

Structure your project into clear services. And as you enter different services, roles, and estimated hours, Scoro automatically calculates costs based on your team’s saved labor and service rates.

To add external costs, simply include third-party services like freelance illustration or paid tools. Scoro keeps internal and external costs separate, so you always see true margins.

When you’re done, you’ll see your total estimated cost and the internal and external costs at the bottom—giving you a reliable financial baseline to shape your pricing.

Step 2: Decide how you’ll track costs and expenses

Once you’ve built a solid estimate, the next step is to figure out how you’ll stay on top of project cost tracking after the work kicks off.

Manual methods like pulling time entries, downloading invoices, and cross-referencing spreadsheets might work in the short term. But the more work you take on, the riskier manual project accounting gets.

Why?

Because human errors in reviewing numbers or calculating them quickly compound—leading to budget overruns, missed margins, and reduced client trust.

A professional services automation (PSA) tool like Scoro lets you skip those headaches.

By combining time tracking, project data, and reports in one place, you save you time jumping between scattered spreadsheets and email threads. And it automatically adds up costs and expenses for you, reducing errors.

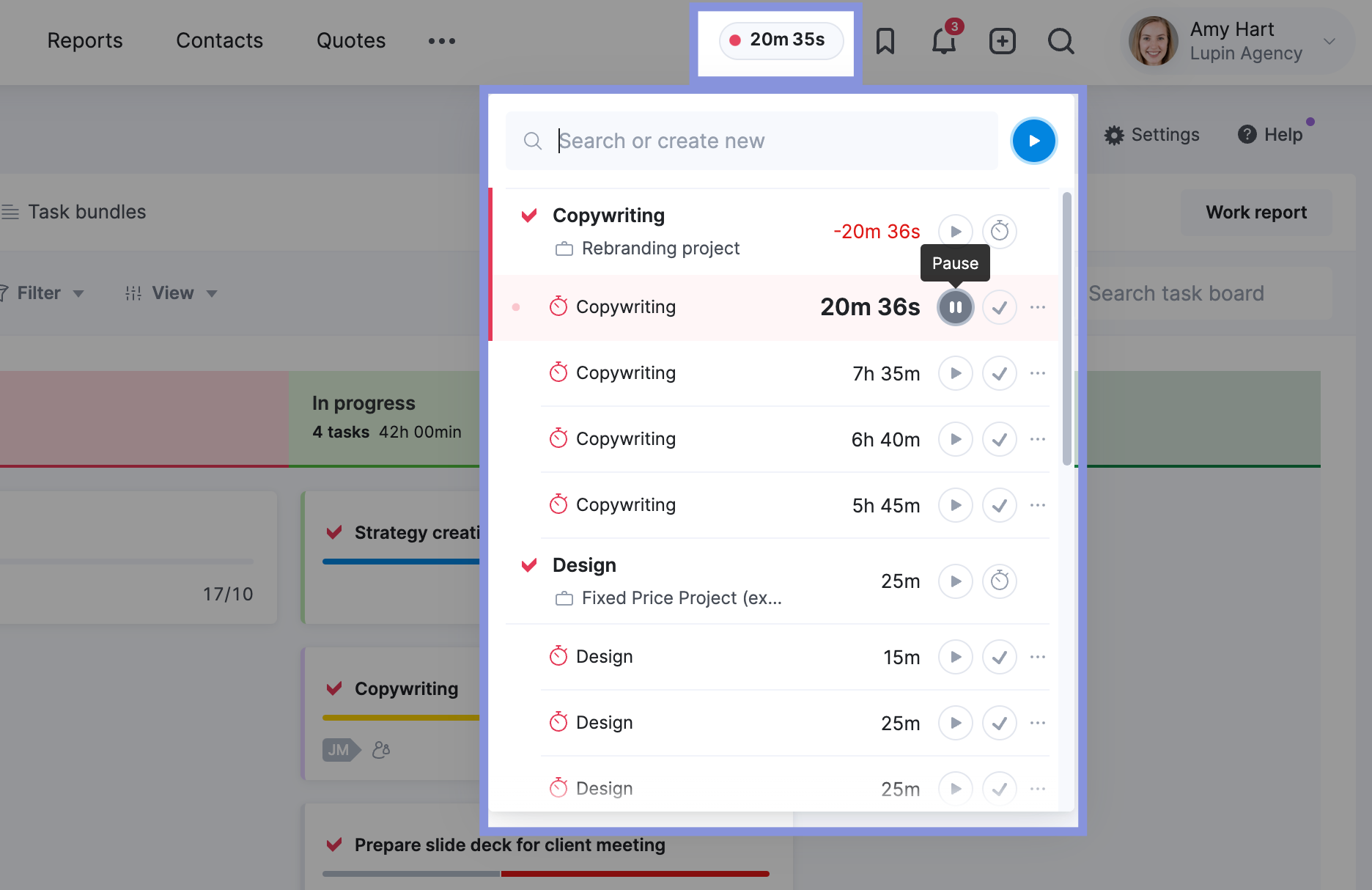

Scoro gives your team three easy ways to track time so you can capture every billable hour accurately:

- Use retrospective timesheets

- Convert automatic calendar entries into time entries

- Start a timer from any task or from the global header

Since every hour is linked to specific tasks and projects, you have a clear view of where time—and money—is going.

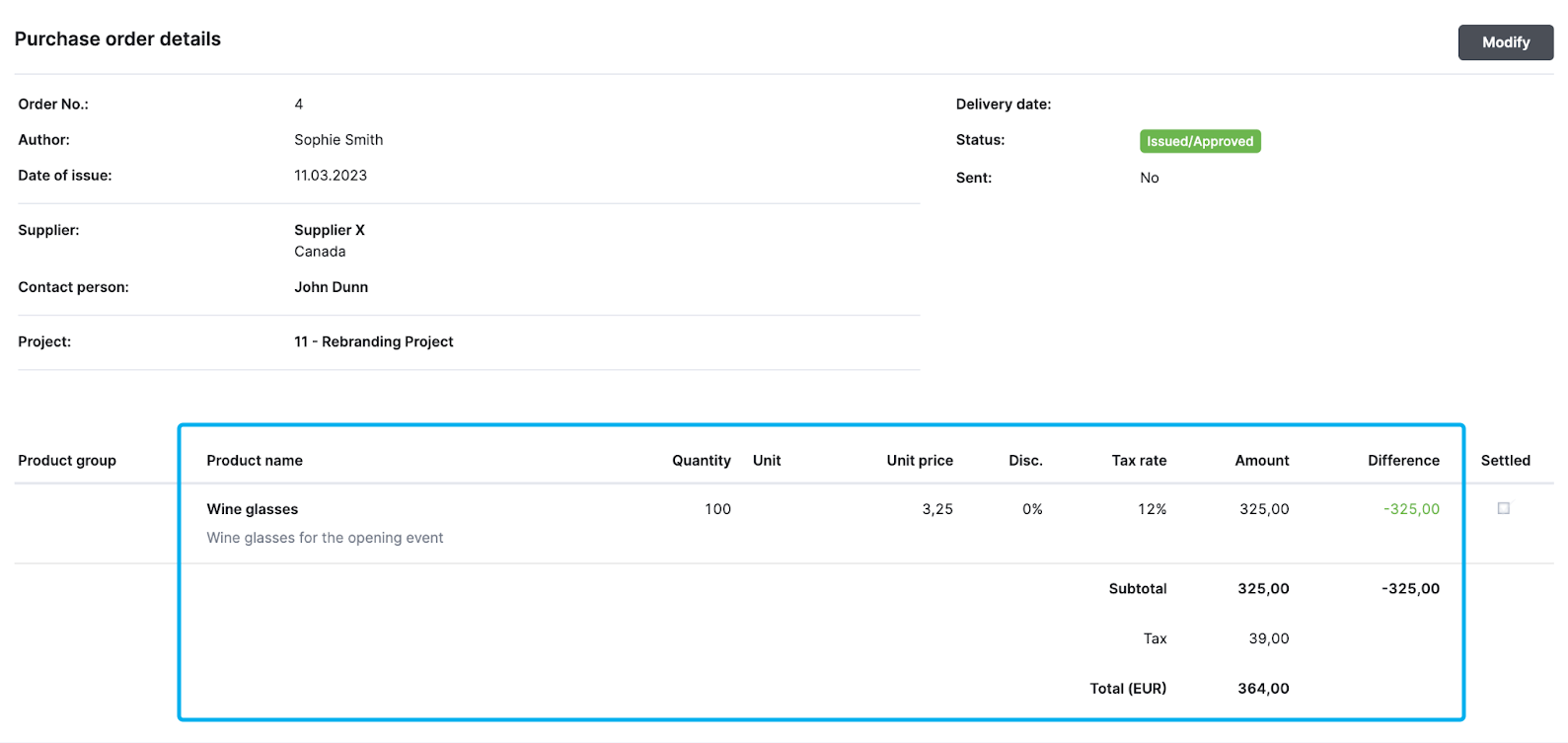

For managing expenses, use Scoro’s purchase orders (POs).

Say Sophie is managing a rebranding project that includes a sporting event.

She knows she’ll need to order wine glasses for the event, so she creates a purchase order directly from her original quote—proactively linking the vendor cost to the project before it starts.

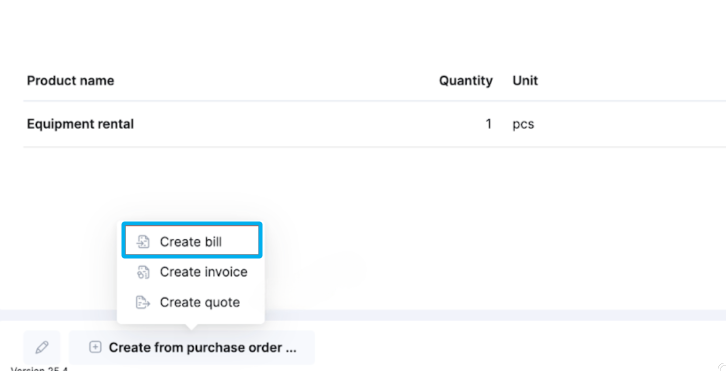

When the final bill comes in, she simply converts her PO into a bill by clicking “Create bill”, updates the pricing if needed, and keep expenses updated in real time.

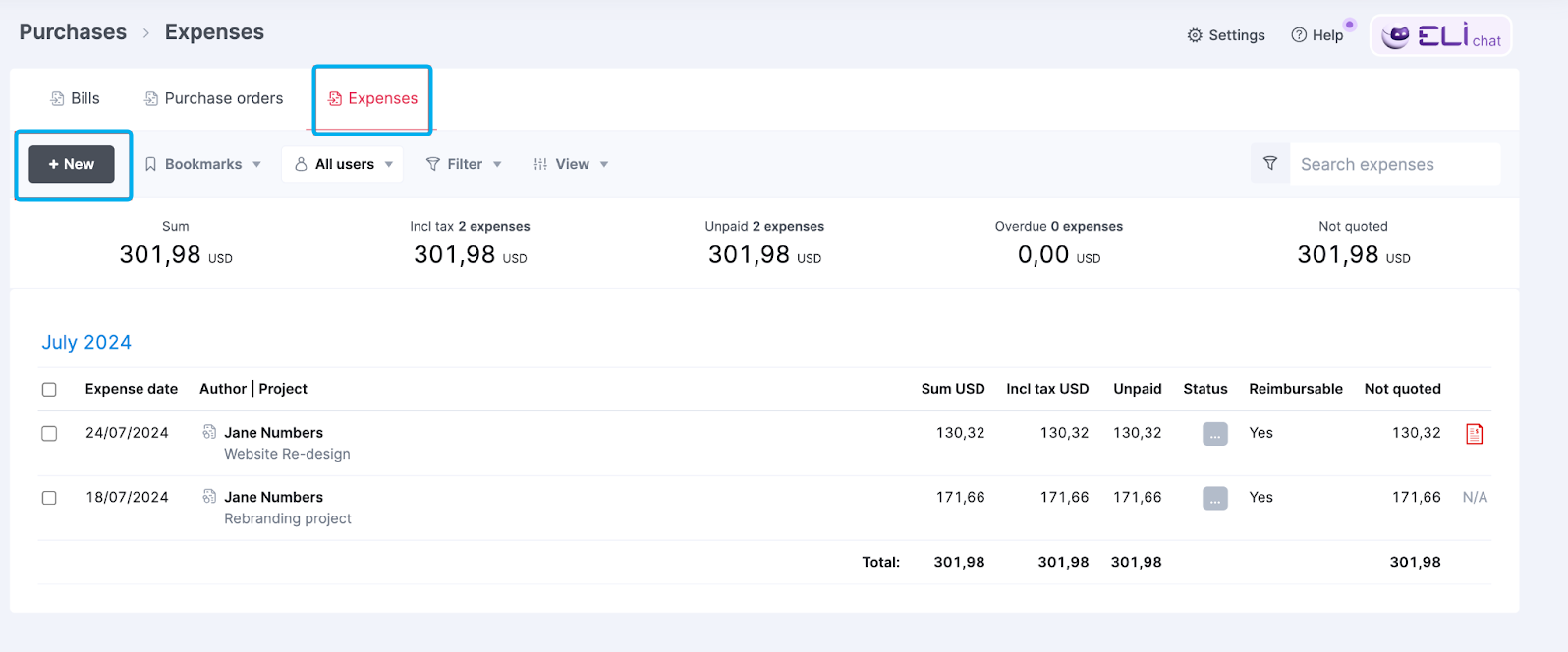

And she can add any unexpected expenses by clicking the +New button in the Purchase > Expenses section.

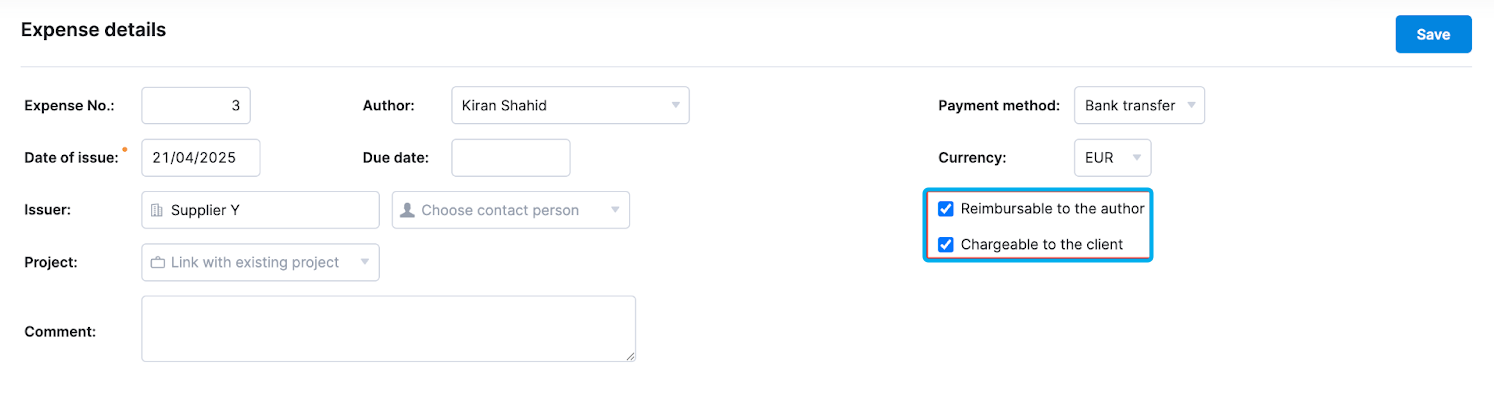

And if a team member covers the cost upfront, they can mark it as reimbursable.

Step 3: Choose a revenue recognition method

Revenue recognition is when you record income in line with what’s actually been delivered—not what’s been billed.

Without it, profit reports can look inflated. And cash flow forecasts become unreliable.

For example, billing $50,000 upfront for a six-month retainer and recording it as income in one month makes it look like you brought in way more than you did.

So your profit and loss statement (P&L) will be skewed and won’t reflect appropriate revenue in future months—even though the project is still ongoing.

Choose from four different revenue recognition methods for a more accurate view of your project’s financial health:

| Method | Best for | How it works | Example |

|---|---|---|---|

| Completed Contract | Short-term projects | Income is only recorded when the entire project is finished | A three-month website redesign project where you get paid at the end |

| Time & Materials (T&M) | Agencies, consultants | Income is recorded as hours are worked and billed to the client | A marketing agency billing a client biweekly for social media management |

| Percentage of Completion | Long-term contracts | Income is recorded gradually based on project progress | A construction firm recognizing revenue as each phase of a building is completed |

| Milestone-Based | Complex projects | Income is recorded when key project stages are completed | A software development company receiving payments after each feature is built and approved |

Scoro supports multiple recognition models so you can align your revenue tracking with how you deliver value.

Further listening:“Richard Brett: What is ‘rev rec’ and which metrics matter?”

Step 4: Define your invoicing models and find ways to streamline the payment process

A clear, consistent invoicing process is key to maintaining healthy cash flow and reducing time-consuming admin work.

Without one, you risk delayed invoices and payments and billing errors that impact your company’s financial health.

Your invoicing model should reflect how your business delivers value. Some firms stick to one method—like phase-based billing for architecture or engineering. But many use a mix:

| Model | How it works | Best for |

|---|---|---|

| Upfront payment | Client pays a percentage before work starts | Fixed-price projects |

| Milestone-based billing | Payments triggered at project phases | Large, multi-stage projects |

| Time-based invoicing | Clients are billed for hours worked | Consulting, agencies |

| Retainer model | Recurring payments for long-term work | Agencies, freelancers |

What matters is having a clear process for each one.

Start by automating wherever possible with a platform like Scoro, which integrates with accounting tools like QuickBooks and Xero.

This keeps your invoicing data in sync across systems, eliminating double-entry and reducing billing errors.

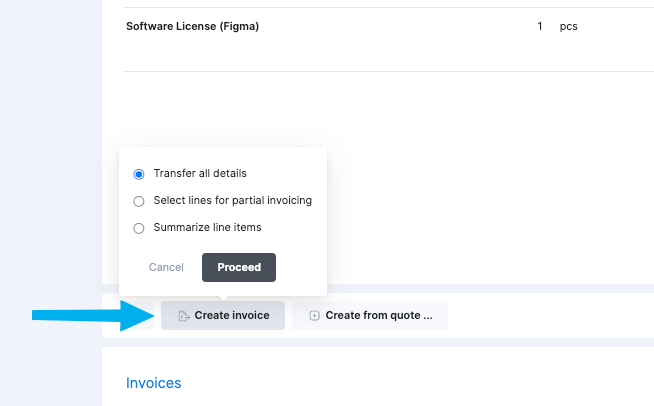

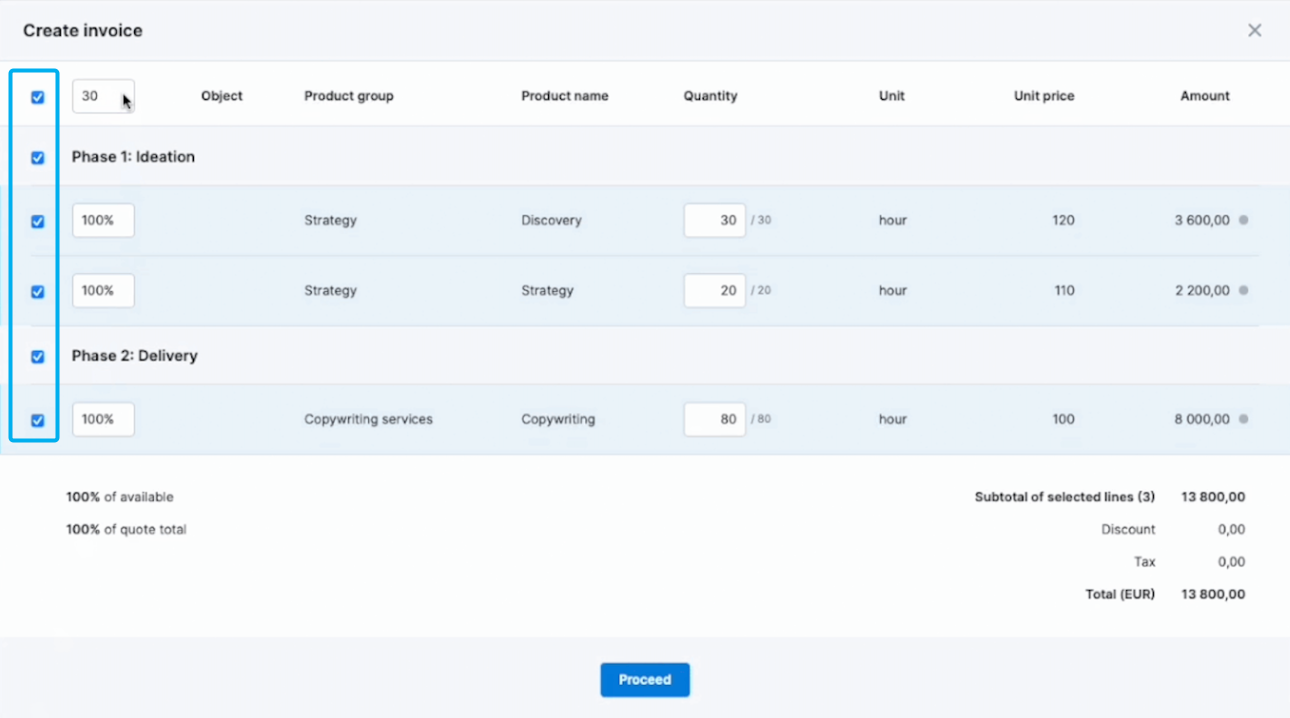

With Scoro, you can generate client-ready invoices directly from confirmed quotes—either for the full amount or by specific phases, like a kickoff fee or final delivery milestone.

Just select a percentage or specific line items you want to bill for. You can then review the invoice to confirm all line items and costs before sending it directly to your client to reduce back-and-forth.

To further improve your invoicing, be as specific as possible in your line items. That transparency helps you clearly account for every dollar billed and reduces client pushback.

And set and repeat clear payment terms. Define terms like Net 15 or Net 30 in your contracts. Then, repeat them on every invoice to avoid confusion and prevent payment delays.

Step 5: Monitor project financial performance with KPIs

While internal and external cost totals tell you what you’re spending, project KPIs help you understand why—highlighting trends, inefficiencies, and profitability risks before they hit your bottom line.

Without KPIs, early signs of overspending or billing issues can slip by unnoticed. And by the time those issues hit your P&L, it’s often too late to fix them at the project level.

Start with these project accounting metrics to help you focus on what drives profitability instead of spreading your attention across every possible data point:

| KPI | What it is | Why it matters |

|---|---|---|

| Income | Total revenue recognized on the project (what you bill the client) | The top-line against which all costs are compared—if this isn’t growing or hitting estimates, profitability will suffer. |

| External cost | All third-party expenses (vendors, subcontractors, hard costs) | Keeps you honest on what you’re paying out to others—uncontrolled external spend erodes margin before you even start. |

| Gross income | Income minus external cost | Reveals how much remains to cover your internal team and overhead—your “raw” project margin before labor costs. |

| Internal labor cost | Sum of all staff hours × their internal billing rate | Tracks the true cost of delivering the work in-house—critical for spotting overruns in time or resource allocation. |

| Project profit | Gross income minus internal labor cost | The bottom-line on each project—your principal indicator of whether a project is actually making money. |

| Delivery margin | (Project profit ÷ Income) × 100 % | Shows profit efficiency as a percentage—easier to compare across projects, contracts, or service lines at a glance. |

These six KPIs give you a concise view of revenue, cost drivers, and end-profit efficiency—so you can spot overruns early and take corrective action before they hit your P&L.

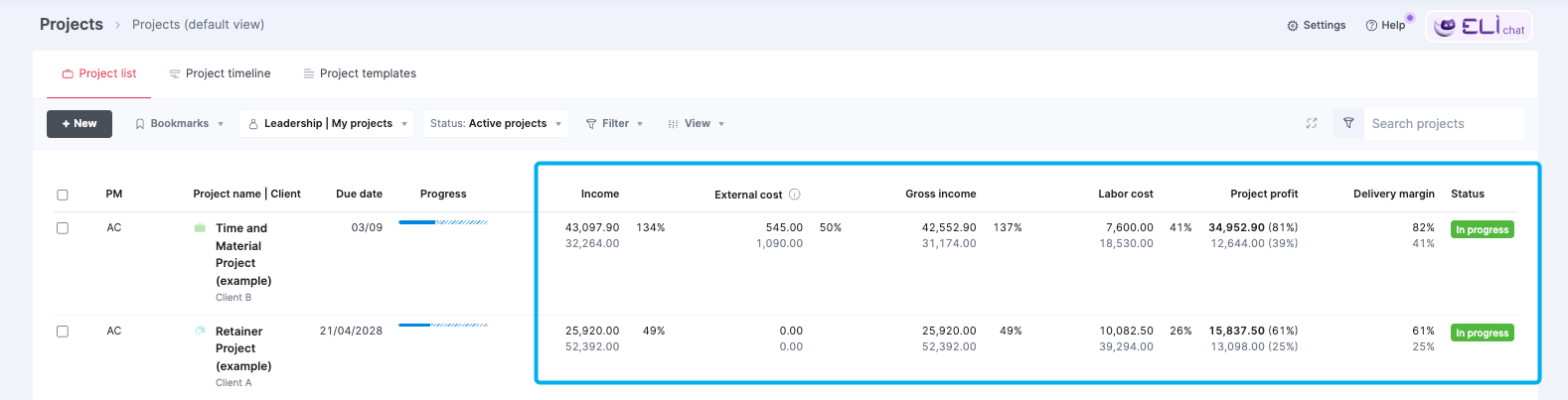

Keep an eye on these KPIs in Scoro’s “Project list.”

Here, you’ll find a high-level snapshot of financial performance across all your projects.

Customize columns by clicking “View” > “Data columns” to include:

- Income (revenue from client invoices)

- External cost

- Gross income

- Labor cost

- Project profit

- Delivery margin

For each KPI, you’ll see your estimated (gray) vs. actuals (black) to compare your planned figures with your current ones.

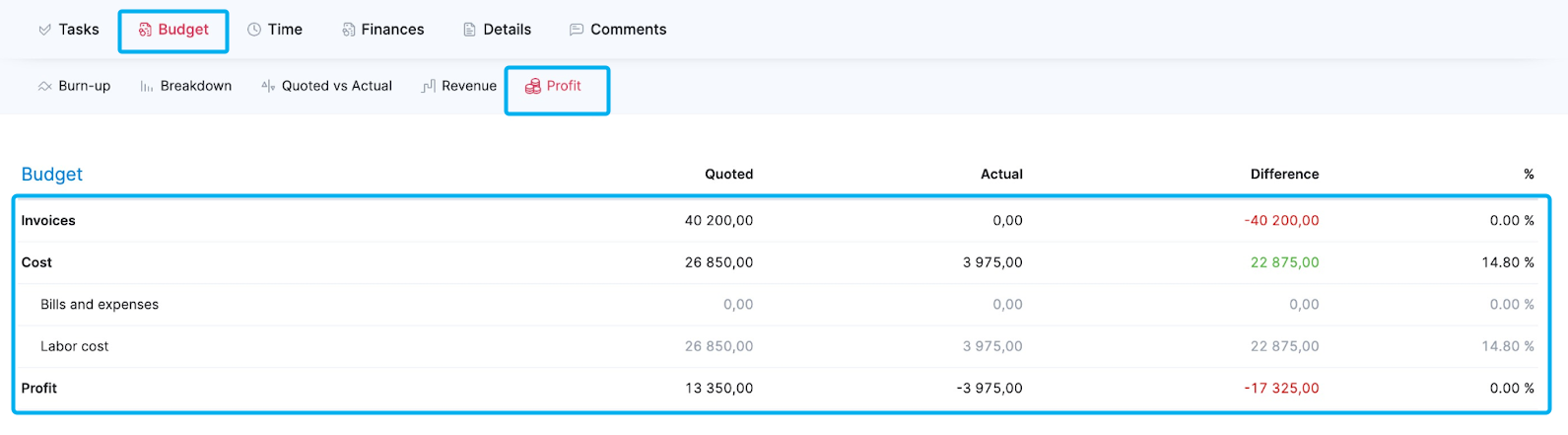

If you only want to look at one project, head to “Budget” > “Profit” to review its financial data:

Use the insights to flag scope creep, budget overruns, or underbilling before they affect your bottom line.

Turn visibility into profitability with Scoro

For professional services firms, profitability doesn’t just depend on delivering great work—it hinges on how well you track costs, margins, and financial performance.

Take Design de Plume, for example. After switching to Scoro’s project accounting software, they replaced manual reports and scattered tools with a connected system that gave them visibility into every project. The result? A 20%+ boost in profitability and a more focused, engaged team.

Level up your project accounting and try Scoro for free for 14 days.