Revenue recognition sounds dry.

But it’s the key to knowing how much money your business is actually making.

Not just how much you’ve billed.

Most firms track revenue when they send invoices or receive payment.

But that’s not what revenue recognition means. It’s about recording income when the work is delivered.

If you invoice a million pounds for work to be delivered next year, you’ve booked the revenue this year—but none of the cost. That’s the illusion rev. rec, is designed to correct.

In short: invoicing ≠ income.

And if you get that wrong, your P&L, hiring decisions, and growth plans can all start to fall apart.

In this guide, we’ll break down what revenue recognition really means, how to apply it in a professional services context, and how to track, forecast, and grow your firm with confidence.

Why revenue recognition matters for service firms

If you’re billing clients upfront but delivering work over months, traditional accounting can trick you into thinking your business is healthier than it is.

Say you invoice $100,000 in January for a 12-month project. If you record all that revenue at once, your profit and loss statement shows a big spike in January and nothing after that.

That doesn’t reflect reality. And it sets you up for trouble.

Here’s what goes wrong:

- Your profits look inflated in the month you invoice. It feels like you’re crushing it, but that’s not reality

- Your costs still show up month by month, which means your margins swing wildly—high early on, low later

- Your cash flow planning gets messy. You might hire or spend based on “earned” income that hasn’t actually been earned

- If the project stalls or gets canceled, you’ve already claimed revenue for work that never happened (a compliance red flag under ASC 606 and IFRS 15).

Revenue recognition solves all of that.

When you recognize income as work is delivered, you:

- See your real financial position

- Make hiring and investment decisions based on earned value

- Get clearer insight into project profitability over time

It’s not just a rule. It’s how you tie your finances to reality.

Revenue recognition isn’t about numbers. It gets departments thinking about resourcing, time tracking, and true performance. It forces you to ask: have we really earned what we booked?

Revenue recognition methods for professional services

Revenue recognition isn’t one-size-fits-all. The best method depends on how you price your services, how your projects are structured, and how closely you track delivery.

Most professional services firms use one of these three approaches:

| Method | Best for | Revenue trigger |

|---|---|---|

| Time-based % completion | Hourly projects, retainers | As time is logged |

| Cost-based % completion | Long projects with clear cost tracking | As costs are incurred |

| Income-to-date | Fixed-quote, unit-based delivery | As units (e.g. hours or products) are delivered and priced |

1. Time-based % completion

This method recognizes revenue based on time logged by your team.

It’s ideal for time & materials (T&M) projects or retainers where hours are your main unit of delivery.

Use this method if:

- Your project is billed hourly or monthly

- Time is your core output (e.g. consultants, developers)

- You have accurate time tracking in place

- Your team logs hours consistently and honestly

For example, say your in-house designer worked 25 hours on a project at an hourly rate of $150.

The recognized revenue for those 25 hours would be $3,750 (25 hours x $150).

But here’s the catch:

Revenue recognition is only as accurate as the time tracking data behind it.

To understand how much work has been delivered—and how it compares to your original plan—you need consistent, trustworthy input from your team.

If time entries are patchy or inflated, your revenue numbers will be too.

Once time is accurately captured, tools like a WIP (Work in Progress) report can calculate how much revenue you’ve actually earned. Based on work done, not just what was estimated upfront.

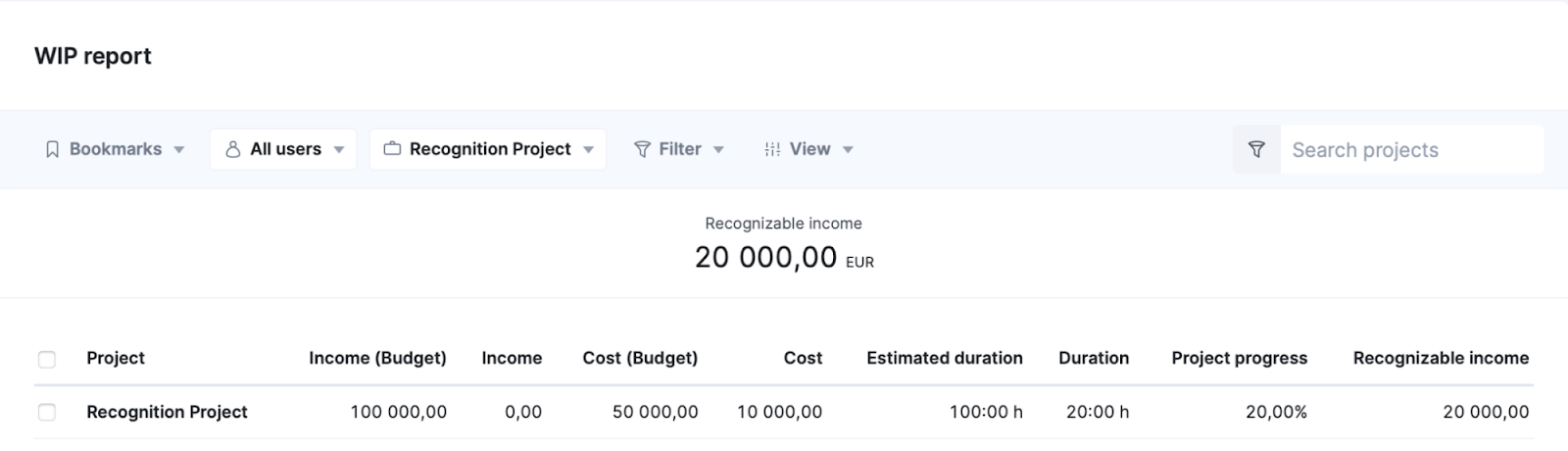

For example, the WIP Report in Scoro shows:

- Estimated Duration: Total planned hours for the project (e.g. 100 hours)

- Duration: Actual completed hours (e.g. 20 hours)

- Project Progress: Automatically calculated as Duration / Estimated Duration (e.g. 20%)

- Income (Budget): The total revenue expected for the project (e.g. €100,000)

- Recognizable Income: Project Progress × Budgeted Income (e.g. 20% × €100,000 = €20,000)

You can also apply a date range filter to understand how much revenue can be recognized in a specific period (for example, in the previous month):

Top Tip

If your team already works from scheduled tasks or meetings, Scoro can automate much of your time tracking. Calendar events and scheduled focus blocks can log time automatically—so you don’t have to rely solely on manual entry. That means fewer gaps in your data, better reporting, and cleaner revenue recognition.

2. Cost-based % completion

This method recognizes revenue based on how much cost you’ve incurred so far.

It’s a great fit for long-term, fixed-fee projects with significant external costs. Like subcontractors, materials, or outsourced work—where time alone doesn’t reflect progress.

Use this method if:

- Your project includes high-cost freelancers, vendors, or materials

- You have reliable cost tracking (both actual and budgeted)

- Time logs don’t reflect real progress

- You want to match revenue to financial outlay

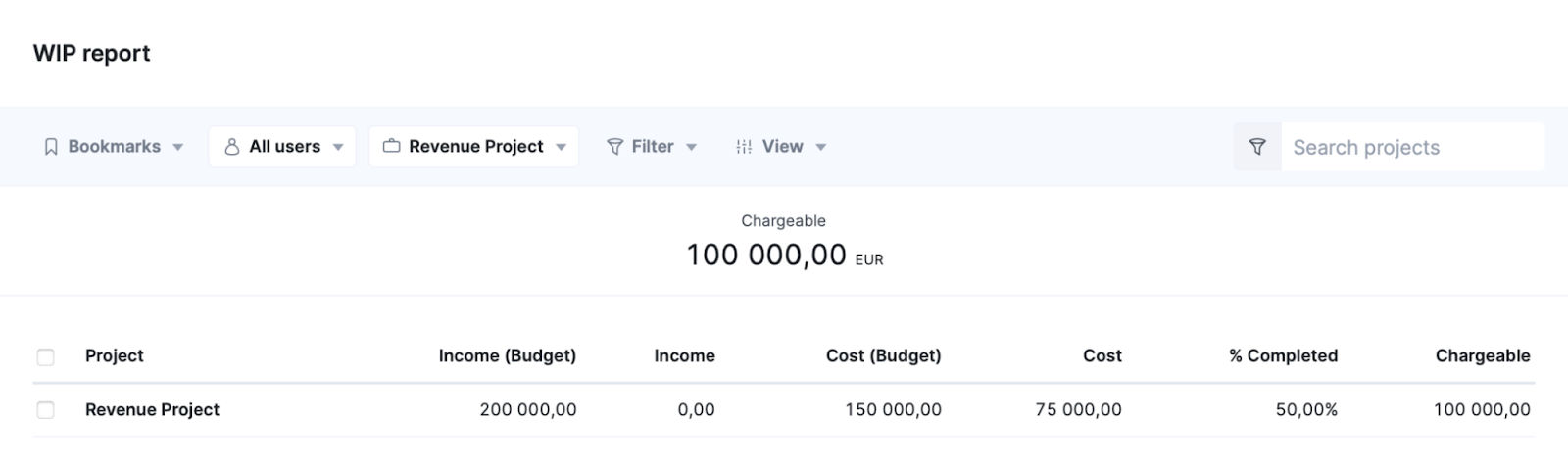

For example, let’s say your total estimated project cost is €150,000.

By the end of the first month, you’ve already incurred €75,000 in costs.

That means you’ve completed 50% of the project—so you can recognize 50% of the revenue.

If the total budgeted income is €200,000, that’s €100,000 in recognized revenue.

Like with the time-based method, you need visibility to make this work.

The WIP Report gives you the breakdown you need, using cost instead of hours.

- Cost (Budget) – Estimated total cost of the project

- Cost – Actual cost incurred to date (e.g. labor, bills, expenses)

- Completed % – Cost ÷ Budgeted Cost (e.g. €75,000 / €150,000 = 50%)

- Income (Budget) – Total expected revenue

- Chargeable (Recognized Revenue) – Completed % × Income (Budget)

This method is especially helpful when your cost tracking is more accurate than your time estimates. Giving you a financially grounded view of progress.

3. Income-to-date (Units delivered × selling price)

This method is based on what’s already been delivered, multiplied by unit price. It’s best for fixed-scope or unit-based engagements with clear deliverables.

Use this method if:

- You’ve quoted by units (e.g. hours, components, deliverables)

- You can measure delivery in clean, billable chunks

- Work doesn’t follow a linear schedule

- You want to see exactly what income has been earned

Example 1:

You quoted the client 100 hours at €200/hour.

You’ve delivered 50 hours.

You recognize €10,000 in revenue (50 × €200).

Example 2:

You also quoted 10 product units at €300 each, and all 10 have been delivered and invoiced.

Total recognized revenue = €10,000 (hours) + €3,000 (products) = €13,000.

Unlike the time or cost based methods, this one doesn’t rely on project progress estimates.

Instead, it reflects what’s actually been done and delivered.

In Scoro—a professional services automation (PSA) tool— the WIP Report tracks this for you with:

- Income to Date (Actual): Revenue based on completed activities and their selling prices

- Income to Date (Capped): Revenue capped at the original quoted amount (e.g. if you quoted 100 hours but delivered 120, only 100 are recognized)

This method gives you a straightforward view of revenue earned—even if delivery is uneven or ahead of schedule.

Final thoughts

Revenue recognition isn’t just an accounting exercise. It’s how you align your financial reporting with the real work being delivered. So your numbers reflect what’s actually happening on the ground.

Get it wrong, and your profits, hiring plans, and investment decisions will be built on fiction.

Get it right, and you’ll have a much clearer view of where your agency stands—and where it’s headed.

Want to go deeper?

Hear FinOps consultant Richard Brett break it all down—revenue recognition, utilization, recovery, billable paid, future work value, and the five levers that affect your agency’s margins.

Or see how Scoro can simplify revenue recognition and boost your agency’s billable utilization with a free 14-day trial.