Are you an Accidental CEO? If you’re a former solopreneur whose success has led to the formation of a company, you may just be.

Do you find yourself overwhelmed with managing your business or agency, trying to balance your essential work with the operational and financial aspects of running an organisation? You’re not alone. Many solopreneurs who started as talented freelancers find themselves in this same position.

The problem is that, while you may be a master of your craft, running a successful agency or business requires a different set of skills.

To thrive, you need to track essential metrics that will guide you to make informed decisions and focus on the right areas to drive profitability.

So if you find yourself struggling to get to everything, find you have more work than ever but are still not seeing any profits or reward for your blood, sweat and tears, these metrics will help you stay on track and turn your agency into a thriving business.

Note: We use the words agency, company, and business somewhat interchangeably throughout this article. Not every business or company is an agency of course, but these metrics can be applied to both agency and non-agency business types.

Why Should You Track Any Metrics at All?

As an Accidental CEO, tracking metrics is essential for the growth of your new business or agency.

Think of metrics as your trusty sidekick – they provide invaluable insights into your agency’s financial health, reveal optimization opportunities, and highlight areas for improvement. Plus, they provide a roadmap for your new agency learning curve, helping you take steps to scale and manage your increased workload.

Of course, not every first-time agency owner is a metrics mastermind. Many may be scratching their heads, wondering where to even begin. Selecting the right metrics to track can be daunting, and interpreting the data can feel like decoding a foreign language.

Despite these challenges, tracking metrics is crucial to a new business’ growth.

Tracking essential metrics will empower you to make data-driven decisions that could skyrocket your agency’s profitability and success.

So, are you ready to take your metrics game to the next level? This guide is your action plan for mastering the essential metrics that every Accidental CEO must track, plus the tools you’ll need to track them effectively.

Identifying The Essential Metrics To Track

The first step is identifying the key metrics most relevant to your agency’s success. These could include:

- Time usage

- Client and Project Profitability

- Billable Utilization

- Billable vs. Non-Billable Hours

- Accounts Receivable Aging

Taking Your Metrics to the Next Level: How to Collect and Analyze Your Data

Now that you’ve locked in your essential metrics, it’s time to talk about the real nitty-gritty – collecting and analyzing the data.

Setting up a reliable system to gather and analyze your data is crucial for your agency’s success. This system could be as simple as a spreadsheet or as complex as specialized software.

Enter Scoro – the ultimate solution for tracking essential metrics and streamlining your workflow.

Scoro goes above and beyond by allowing you to manage projects, track billable and non-billable hours, forecast new business, view margins, and even manage suppliers. Scoro helps you manage all aspects of your new agency and helps you stay on top of actions that keep an organization running smoothly.

From data collection to analysis, Scoro allows you to capture and harness data, giving you visibility into every aspect of your business, all within one beautiful dashboard. It’s the comprehensive solution your agency needs to take control and achieve unprecedented success.

Essential Metrics To Track

We’ve gathered these into order of significance. In essence, starting by tracking and logging time creates a cascading effect where the other metrics listed become possible to track and optimize.

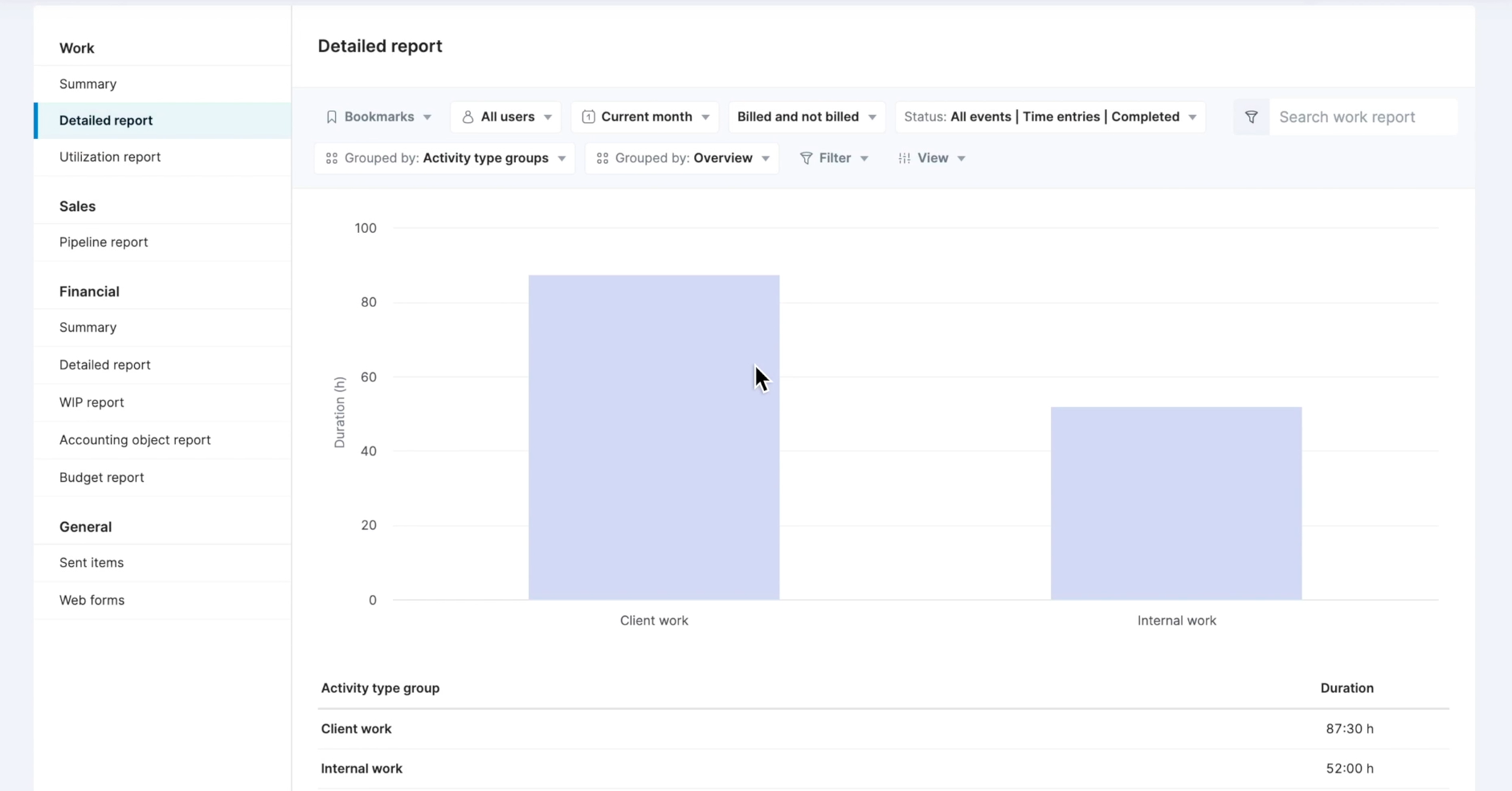

Time usage

It all starts with the most basic but vital measurement – time and how you use it. Without tracking how time is spent, where it is wasted, where it can be optimized, and how much it costs you, everything else is nebulous guesswork at best. Having complete visibility into every aspect of time at your agency gives you the power to manage resources and workloads effectively.

Many agencies, especially small and new ones, are terrified of time tracking, as they have the idea that it will create an oppressive work environment where creativity is stifled and employees spend more time logging their activities than actually working on things that bring value. In fact, the exact opposite is true.

When you understand how much time a project takes, how much time you have available, and where you can improve your utilization, you can ensure that your employees have a balanced, manageable and steady workload. Being stressed and overworked, with unrealistic deadlines and unfair workloads for some employees while others are idle is far worse for morale than using a time-tracking tool.

Scoro lets you track time on a task and project level, as well as access detailed reports on how time is spent overall. Start by tracking and logging time, and the rest should follow naturally.

See how Scoro helps you log and track time.

Client and Project Profitability

Many Accidental CEOs are super-focused on the profit and loss statement at the end of the month, and this is quite understandable, after all, you’re in business to make a profit. But unless you develop a granular level understanding of what is driving these numbers, you’re like someone trying to figure out the plot of a novel by only looking at the cover. Sure, you can make a fairly educated guess, but that won’t help you move the needle.

Tracking client profitability is essential for a new agency to understand both which clients generate the most revenue and which of your projects are actually driving profit. The two are not always the same.

Complex, lengthy projects may be high revenue generators, but often carry high labor and pass-through costs (paying freelancers, suppliers, marketing, travel etc.). Tracking client revenue versus profit allows you to make data-driven decisions about where to focus your resources.

By logging time against the projects and services, it’s possible to understand which clients or services bring in the highest and lowest margins and make adjustments accordingly. If you find that you are constantly underestimating the time needed on a project and overservicing clients as a result, this data will allow you to improve scoping for the next time, meaning you can ask for more money from the customer during the quoting phase or cut the scope so you could deliver within the estimated hours.

If there are specific customers or services that “steal” your margin, you can decide to stop serving those clients or offering those services.

You will also get a clear view on which employees take longer to complete their assignments, which means you can actively work on their skills to improve their productivity.

Scoro’s project portfolio view shows you which projects and clients bring the highest profit and which are actually eating into your margins.

Billable utilization rate

Billable utilization rate is the amount of time one employee spends working on client-facing tasks vs. the total amount of time that an employee is available to work. A very low utilization rate means that you’re most likely burning money on salaries, have a low workload with too few projects, and are not managing your business effectively.

But beware. Aiming for a 100% utilization rate may seem the logical course of action, but may end up leaving no time for employee development, team-building or admin tasks. While a utilization rate of between 85% and 90% is seen as a healthy industry benchmark, not all businesses are the same. Track yours, then decide where the sweet spot for your business and employee needs lies.

The Scoro utilization report will give you full insight into how much of your team’s time is scheduled, available, and used efficiently. And it’s also your crystal ball to look into the future. Expanding the usage report to encompass upcoming periods will give you insight into your business’s projected performance for the next few months. A low utilization rate could indicate the need to accelerate sales efforts in order to obtain new projects and maintain your team’s workload.

Billable vs. Non-Billable Hours, Per Employee, Per Team

Billable hours are hours completing work that can be charged to your client. Non-billable hours are those spent on non-revenue generating tasks, such as admin, internal projects, and internal meetings. Of course, to maximize revenue, you’ll need to maximize the billable hours your team spends on projects. It is also important to understand that, even if you practice value pricing i.e. you bill a client for the entire project rather than charge per hour rates for resources, the distinction between billable and non-billable hours remains in place.

Understanding the amount of time your agency spends on the tasks that directly generate income will allow you to identify inefficiencies and optimize resources.

For example, if you run an advertising agency and your lead designer is spending 30% of their time in team-building activities and 10% training new hires, you may need to take another look at how your workflows and priorities are structured.

In Scoro, this is easy to see. You can drill down into individual utilization, seeing how much time remains for each team member and what they are spending their time on. Finally, you can use all this information to forecast sales and track your agency’s goals.

Accounts Receivable Aging

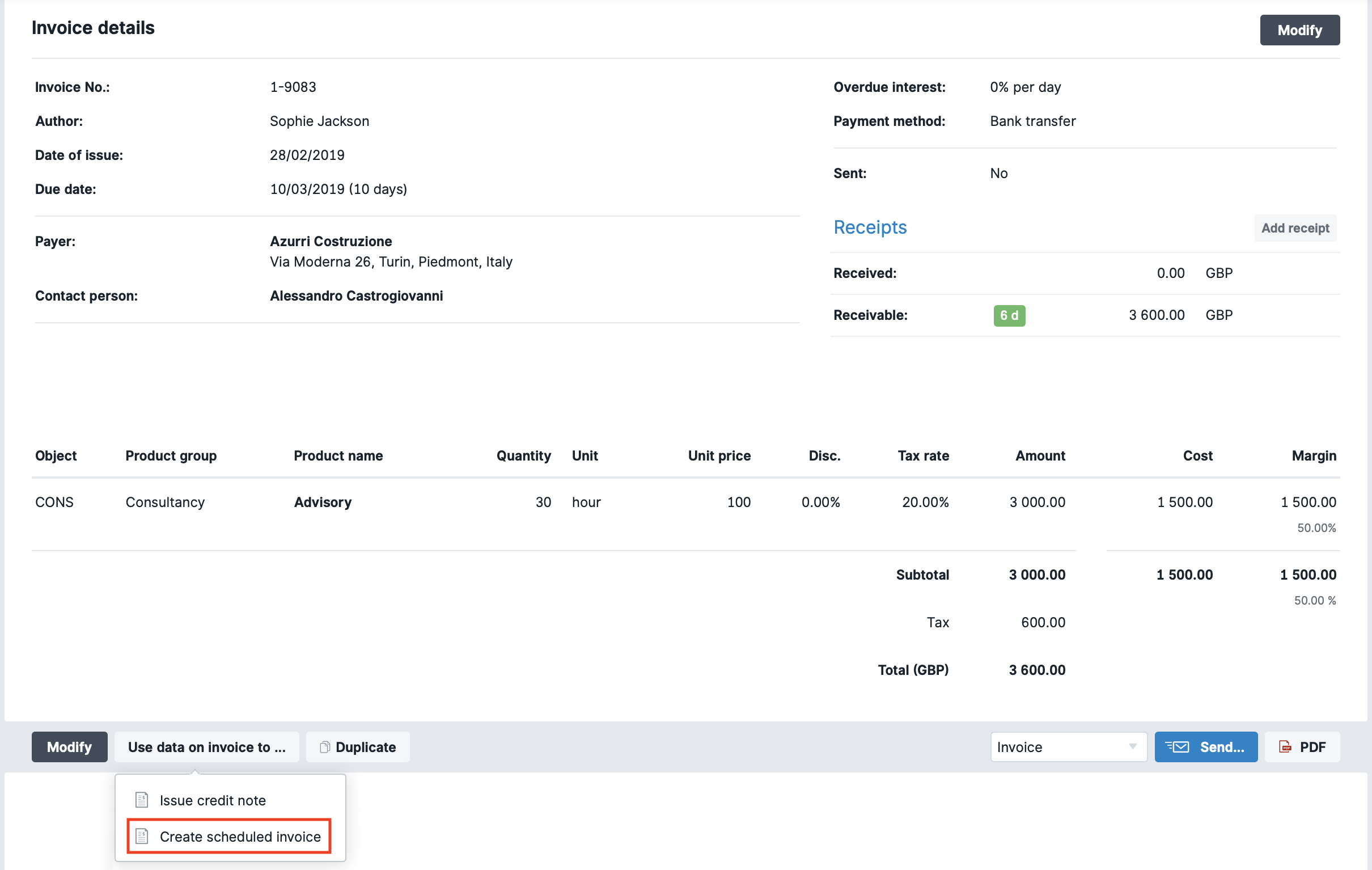

When you boil it down to its bare essence, you’re in business to make money, and that means you need to get paid. Accounts Receivable Aging tracks the amount of money owed to your agency by clients and how long it has been outstanding. By tracking this metric, you can ensure you are getting paid on time and address any payment issues before they become problematic.

Healthy cash flow is absolutely vital to the success of fledgling agencies, unless you have some serious cash reserves to cover all your costs while you wait to get paid. Chasing invoices, forgetting to submit them on time to slot them into clients’ payment cycles, or getting them wrong entirely are time sucks of note. By automating your invoicing you give yourself the ultimate gift – time.

Even small agencies often have many clients and work on multiple projects. If profit margins are tight, something as simple as forgetting to invoice on time or not noticing that a client has not paid before the end of the month can be disastrous.

Monitoring and using the data can help you pinpoint problematic clients and bring a level of predictability to your finances. It’s better to spot issues while they can still be rectified than after the fact.

Scoro’s invoicing system allows you to automate your billing processes, send invoices on time, and track payment status in real time. With overdue reminder prompts, it’s easy to stay on top of invoicing, helping your clients pay on time and ensuring your cash flow remains steady.

Transforming Your Metrics Into Action: How to Use Data for Growth and Success

Congratulations, you’ve collected and analyzed your essential metrics! Now, it’s time to turn that data into actionable steps to drive your agency’s growth and success.

Here are some tips on how to take action with your newfound data:

Identify areas for improvement:

The data doesn’t lie. By pinpointing underperforming areas of your agency, you can develop effective strategies to turn things around.

For example, if specific clients generate less revenue than others, you can develop targeted plans to increase sales and drive revenue growth.

Optimize your resources:

Tracking how your time is spent can reveal opportunities to optimize your team’s efforts and resources.

You can assign team members to more revenue-generating tasks or consider hiring additional staff to handle non-revenue-generating tasks. You can identify lost time, and drill down per employee, to ensure that every team member has enough on their plate.

Make informed decisions:

Using data to inform your decisions will empower you to steer your agency in the right direction.

For instance, if you observe that a particular service isn’t generating sufficient revenue, you can consider pivoting your business model to focus on more profitable services.

Set achievable goals:

Using data to set realistic goals for your agency’s growth and success is a game-changer.

For example, if your profitability levels aren’t where they need to be, and you have a clear indication of how revenue and profitability in your agency relate to each other, you can set a goal based on that margin to increase revenue by a certain percentage over the next quarter, fueling your agency’s growth and propelling it toward success.

Remember, metrics are your agency’s best friend, and by taking action based on your data, you’ll set your agency apart and experience unprecedented growth and success.

Tracking Metrics For Success

Tracking essential metrics is the cornerstone of any successful new agency.

By honing in on and tracking the right metrics, you’ll gain valuable insights into your agency’s financial health, streamline your operations, and uncover opportunities for improvement.

For new agencies like yours, Scoro is a game-changing tool that can help new agencies navigate the complex world of metrics tracking to achieve their goals. With Scoro, you’ll have everything you need to monitor your financial health, optimize your operations, and identify areas for improvement, and all in real time, so you know where your business is heading. It’s better to head off issues before the fact, rather than look back in regret at the end of the month or quarter.

From project management to time tracking, invoicing, and financial reporting, Scoro’s comprehensive solution has it all – and by leveraging Scoro to track and analyze your agency’s metrics, you can make informed decisions to drive profitability and success.

Start tracking your essential metrics today, and let Scoro take your agency or business to new heights.