Remazing is a leading international provider of services and software solutions for brands on Amazon and other online marketplaces. The agency helps global brands monitor, optimize, and advertise their presence on Amazon.

Before Scoro, Remazing relied on a disconnected mix of SevDesk and Google Sheets to manage finances and budgeting. As the team grew to over 100 employees, the manual effort required to track budgets and analyze profitability this way became unsustainable. They lacked the data depth needed to truly understand where they were over-investing or under-performing.

With Scoro, Remazing has centralized their quote-to-cash workflow. They now have a professional-grade financial engine that delivers on two fronts: it enforces data quality to give leadership triple the data points they had previously, and automates manual admin to save the team almost two months of work annually.

| Overview | Description |

|---|---|

| Company | Remazing |

| Industry | Amazon Marketing Agency |

| Size | 110 employees |

| Location | Hamburg, Germany |

| What they use Scoro for | Quote-to-cash, time tracking, financial reporting, profitability analysis |

| Impact (numbers) | 3x more profitability and revenue dimensions data points for deeper insights 96 hours/year saved on manual financial reporting and analysis 200 hours/year saved on quote and invoice generation |

| Impact (what changed) | Operational transformation: Shifted focus from manual admin to strategic financial control Business maturity: From reactive “guesstimates” to real-time, trusted profitability data Cultural shift: Employees operate with a “financial lens” in mind rather than just completing tasks |

How Remazing transformed with Scoro

Before Scoro, Remazing was using a limited tool stack to run its daily operations:

- SevDesk for invoicing

- Google Sheets for budgeting, scoping, and manual reporting

In 2022, Remazing decided to transition to Scoro to gain the ability to allocate client budgets to specific teams and enforce better financial transparency.

Here’s a snapshot of what they were able to achieve:

| Before | After | |

|---|---|---|

| Quoting & Budgeting | Scoping was done in Google Sheets and SevDesk. Quotes lacked detail and were often started from scratch, making analysis difficult. | Quotes are template-based and highly customizable, saving the team 200 hours/year on quote and invoice generation. Custom fields allow the team to tag revenue by product group for granular analysis. |

Time Tracking | No time tracking existed. Teams lacked data on workload capacity, actual effort required for tasks, or effective billable rates. | Time tracking is integrated with Google Calendar and the team logs time in Scoro. The team now has a “financial lens”, utilizing data to calculate effective billable rates per employee. |

| Project Management | The team was “freestyling” execution with no financial oversight. The focus was solely on meeting deadlines. | Activity types represent product groups, which allows the team to analyze which product groups teams are investing time in. They can now identify trends in over-servicing and adjust scope for the next cycle. |

| Invoicing | Invoicing was a time-consuming admin task handled in SevDesk. Invoices had to be created from scratch and offered no visibility into revenue performance by service or marketplace. | Invoicing and quoting are connected thanks to Scoro and constitute the engine for data quality, saving the team 200 hours/year by automating the quote-to-invoice generation process. The process automatically allocates budgets to teams, ensuring accurate financial data without manual intervention. |

| Reporting | Financial analysis was manual, time-consuming, and lacked depth because of limited data points. Leadership was manually stringing data together from SevDesk and Google Sheets which lacked real-time visibility. | Reporting is automated and detailed. Leadership has 3x the data points thanks to custom fields and saves 96 hours per year by eliminating manual data aggregation. |

Tech Stack & Processes

Before: Manual workarounds and data gaps

Previously, Remazing relied on SevDesk for invoicing and Google Sheets for quoting and budgeting. While SevDesk was functional for sending bills, it offered limited options for customization or analysis. To get any meaningful financial insights, the management team had to manually export invoice data and combine it with spreadsheet inputs. This process was labor-intensive and prone to errors.

After: One source of truth and automations with Scoro

Scoro replaced the disconnected mix of SevDesk and Google Sheets with a single, integrated platform for the quote-to-cash cycle. Data entered at a quote stage is automatically carried over when a quote is converted to an invoice, eliminating manual data re-entry or reconciliation. Scoro now ties budget allocation directly to the invoicing process, ensuring revenue is mapped correctly inside the system immediately.

The biggest impact has been the higher level of professionalism. Scoro has given us the transparency and data depth that makes us a more mature business.

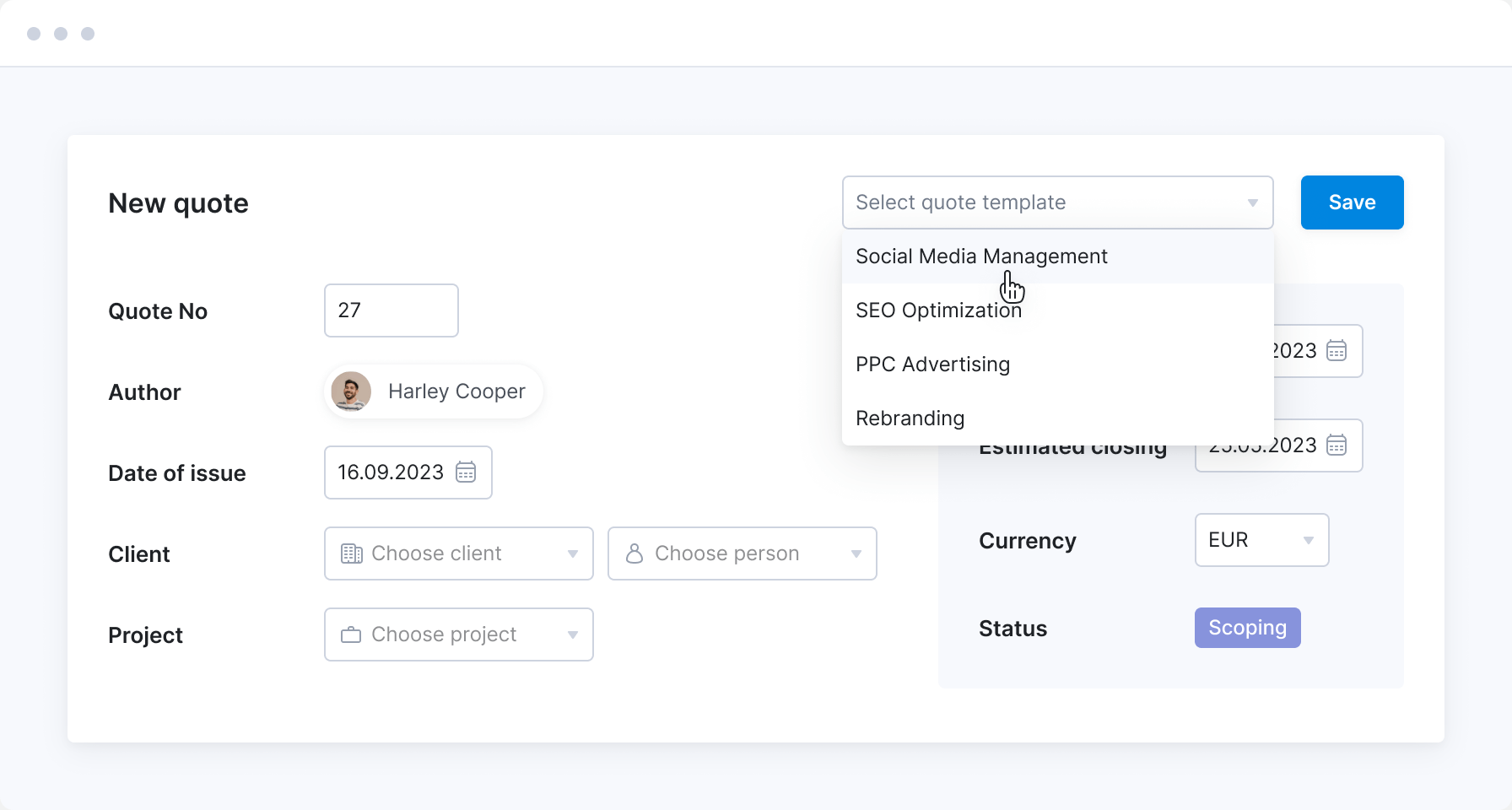

Quoting & Budgeting

Before: Time-consuming quote building process with no data depth

In the past, quoting was a “start from scratch” exercise with no predefined templates. Quotes were often not detailed enough, and because the data wasn’t structured, it was impossible to analyze which services or markets were driving revenue.

After: Template-based quoting with granular financial insights

Remazing now utilizes quote templates and duplicates to significantly speed up the quote creation process. Crucially, quotes are enriched with custom fields to capture specific nuances of their business, such as which Amazon marketplace (e.g., UK, France, Germany) a project targets, allowing to automatically collect revenue data for analysis.

We have triple the amount of data points compared to before. We can analyze revenues by product groups, accounting objects, or even specific Amazon marketplaces. We are now able to see ‘black on white’ what we were only able to guesstimate before.

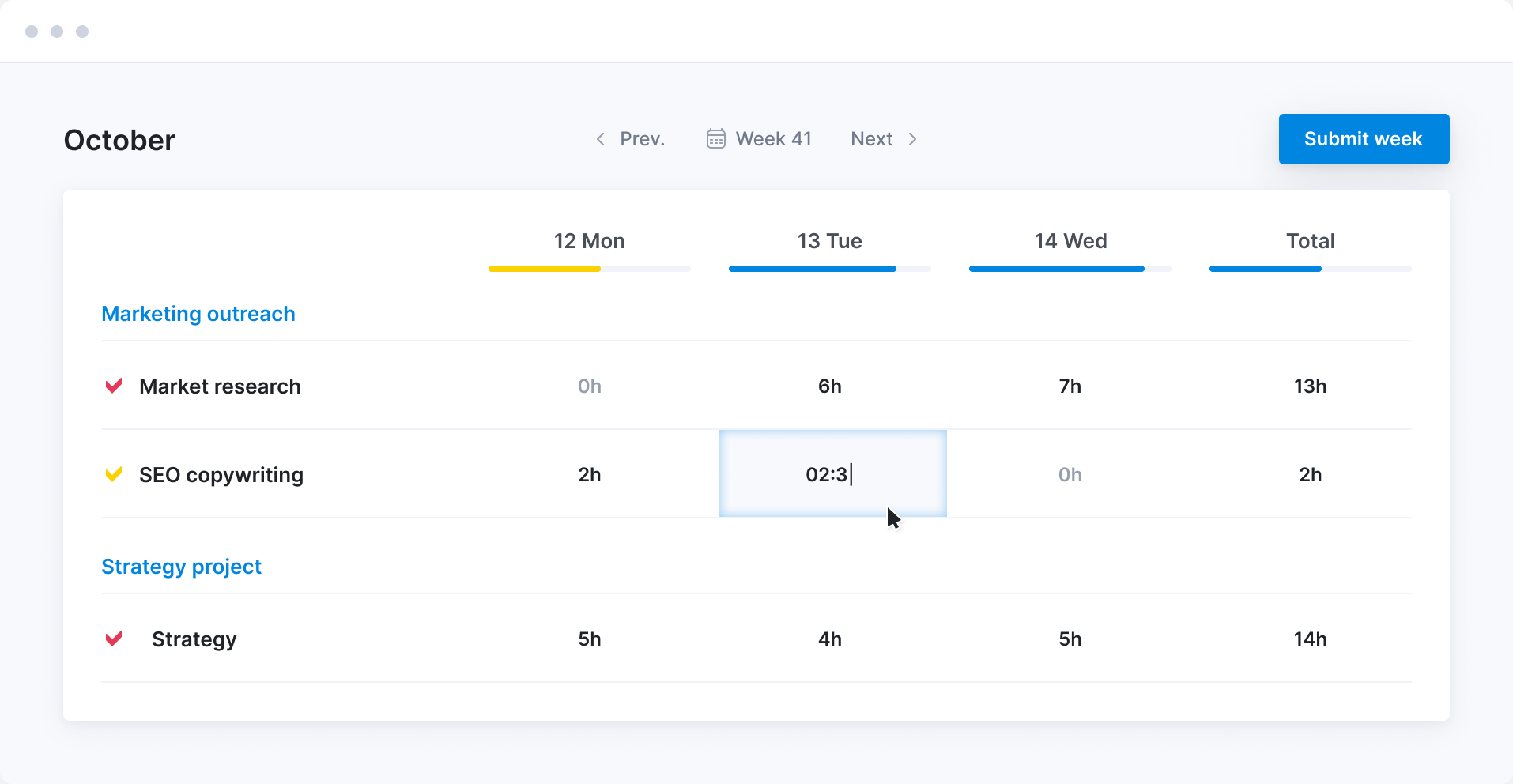

Time Tracking

Before: No visibility on efficiency

Before implementing Scoro, Remazing didn’t track time at all. This left them with no data to understand if they were operating efficiently or if fees aligned with the effort required.

After: Connecting time spent to revenue generated

Consultants log their time in Scoro and sync their Google Calendars with Scoro to easily convert meetings and blocks of work into time logs. By connecting this effort to specific product groups, they can finally compare time spent against revenue generated – revealing the effective billable rates required to ensure profitability across different services.

It has been implemented to change the mindset of our employees. They now think with a ‘financial lens’ – knowing not just that they need to do a task, but thinking about how much time they are actually able to spend based on the scope. It prompts them to operate more maturely.

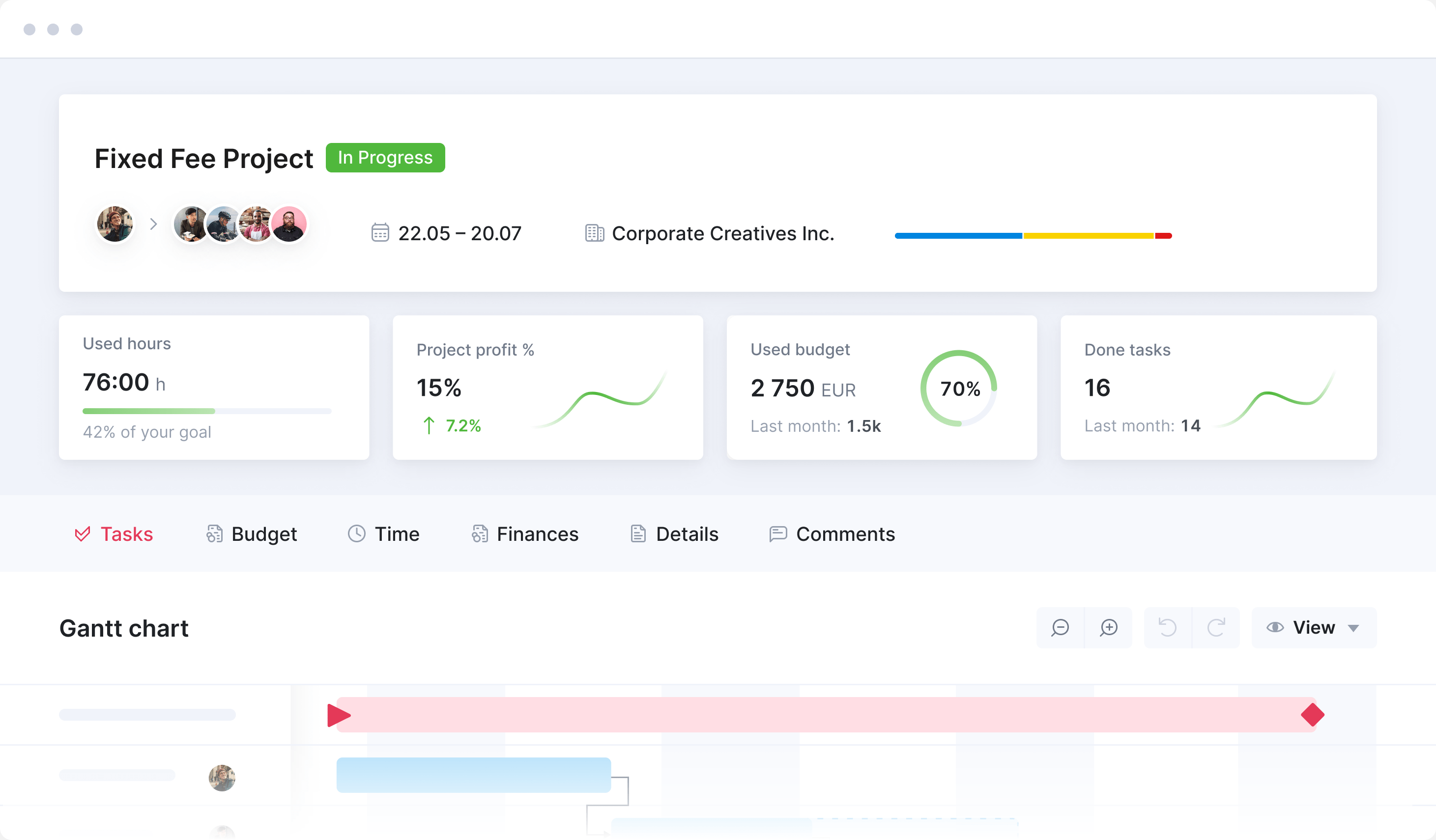

Project Management

Before: Frequent scope creep and over-servicing

Previously, Remazing didn’t have a structured process for managing project finances alongside delivery. The team was often “freestyling,” focusing entirely on fulfilling client wishes and meeting deadlines without paying attention to the costs involved. It was difficult to detect when they were over-servicing or if they were burning through scope too quickly.

After: A framework for financial oversight

Remazing now uses a streamlined project structure in Scoro designed specifically to monitor financial performance and ensure the team is on track with their hours compared to the agreed scope. This allows leadership to run reports comparing actual hours spent vs. invoiced. This data reveals where they’re over-servicing, allowing them to adjust future scopes.

We used to focus solely on delivering on the deadline. With Scoro, we are able to see where we over-service. It allows us to intervene and manage the scope much better.

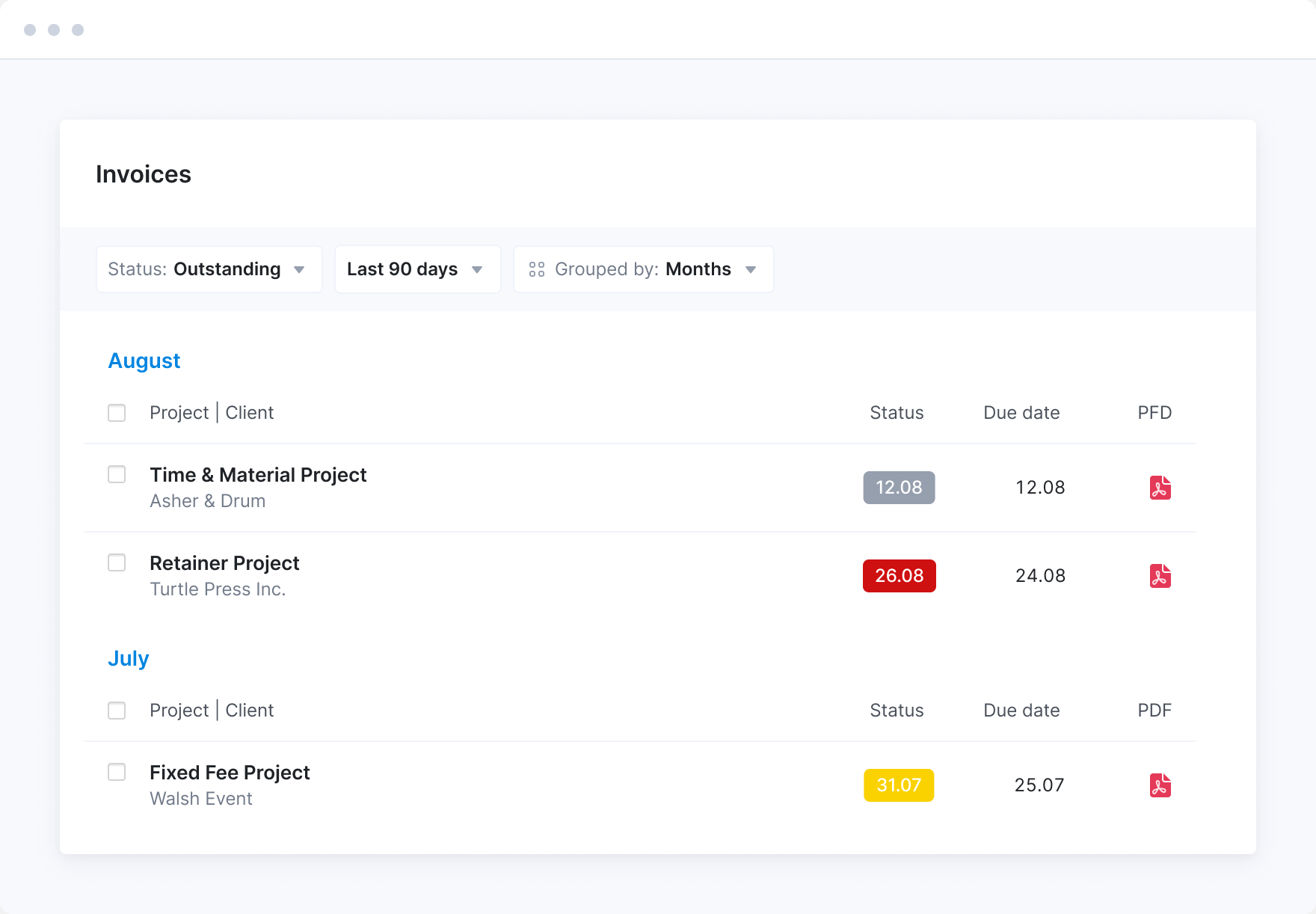

Invoicing

Before: Basic billing with limited data depth

Previously, Remazing used SevDesk for invoicing. While it functioned for sending bills, it lacked the customization needed to track revenue against specific services or marketplaces. The system was disconnected from operational work, meaning financial analysis was a labor-intensive manual process that offered little insight into actual performance until after the month had closed.

After: Automated budget allocation and real-time revenue visibility

Scoro has turned the invoicing process into an engine for financial data. All quotes are automatically linked to invoices. By using accounting objects and custom fields, revenue is automatically allocated to the correct teams and product groups without manual intervention.

In the past, we relied on manual analysis to gain transparency into our key KPIs on a monthly basis. Now, we see revenue performance live. The invoicing workflow takes care of the data allocation for us, which has been a big game changer.

Reporting

Before: Labor-intensive manual aggregation

Detailed financial analysis used to be a heavy lift. The leadership team would manually add data to Google Sheets to satisfy reporting requirements. This friction meant that deep analysis was retroactive and infrequent.

After: Automated insights and detailed financial control

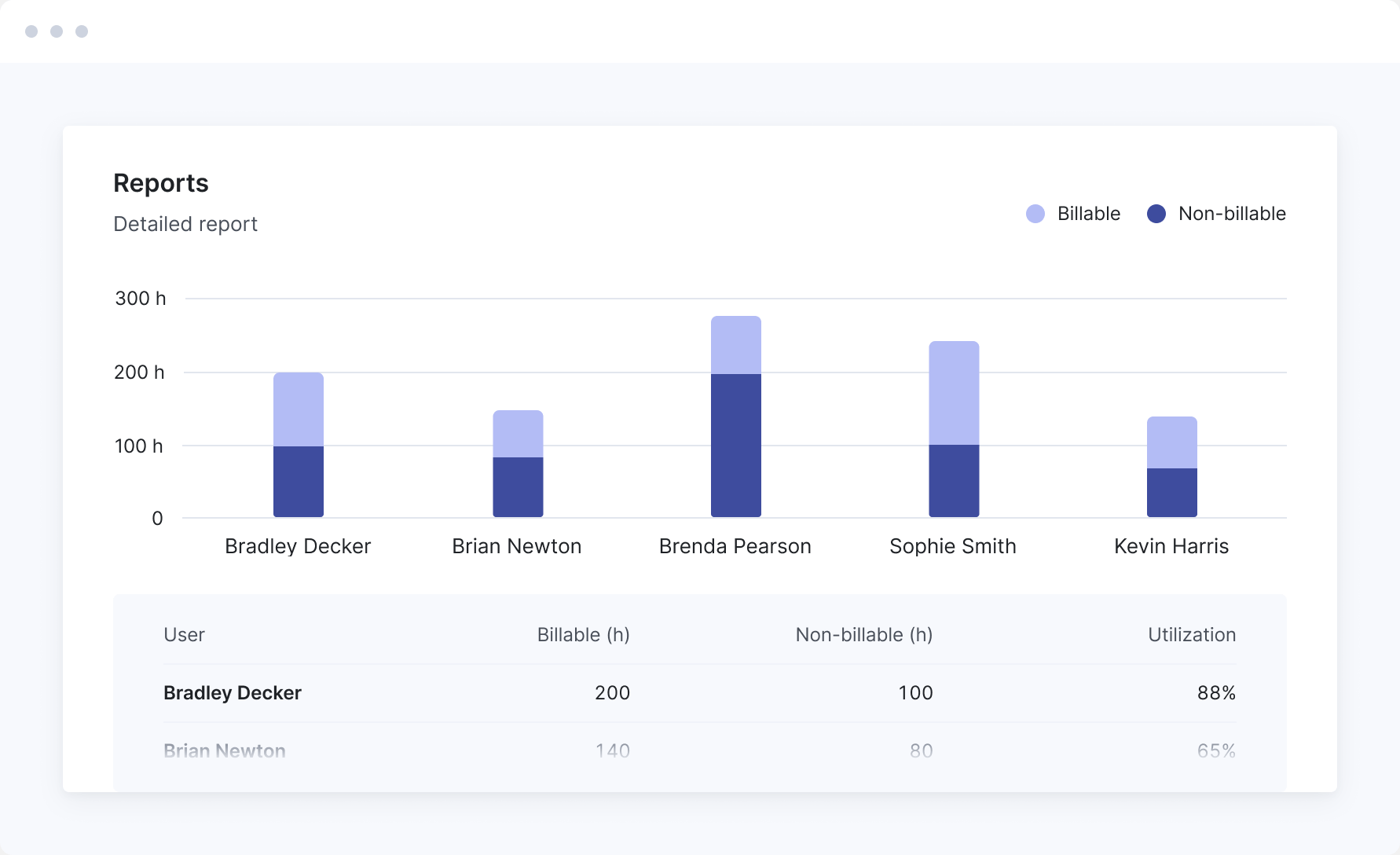

Today, Scoro’s Detailed Financial Report and Detailed Work Report are the go-to tools for Remazing’s leadership. The team can now differentiate between retainers and one-off projects, and analyze revenue by specific product groups. They can instantly view profitability by client, team, or service line which is based on up-to-date data in the system. They also combine Scoro data with their HR tool to calculate effective billable rates per employee.

We save 96 hours per year on reporting alone because we no longer need to manually export and combine data. The workflow just takes care of it, giving us the data at hand automatically.

Business Outcomes

While efficiency gains were significant, the most transformative outcome for Remazing has been a leap in business maturity. The agency has moved from retroactive “guesstimates” to a professional-grade financial operation where data is transparent and trusted. Leadership now has access to 3x the number of data points compared to their previous setup, allowing for sophisticated analysis of revenue streams across all accounting objects.