Many professional services firms overlook the importance of non-billable hires.

You can’t measure their value in pure hours or profit, which makes their impact more challenging to prove.

But non-billable hires are key to keeping profits high.

Their “unseen” work holds the business together. And gives billable team members the bandwidth to focus solely on their jobs and not drown in admin work.

As Lindsey Head, Founder of Pulse Business Group, explains:

Growth isn’t about everyone wearing 10 hats forever. It’s about putting structure underneath so the business isn’t held together by duct tape and goodwill.

In this article, we’ll break down how non-billable hires contribute to that structure and a healthy bottom line. And how to justify the need to hire new roles.

The hidden cost of “free” admin

The belief that billable talent can absorb non-billable work without consequence is a mathematical fallacy.

When founders, PMs, and delivery staff shoulder administrative burdens, utilization rates drop, and margins compress.

Consider the math:

If a delivery lead loses 10 hours per week to non-billable tasks, you lose 40 invoiceable hours per month.

You aren’t saving on overhead; you are paying premium rates for data entry.

Your team should be spending time on client results, not flipping through receipts or re-entering contracts.

Are your billable employees losing time to non-billable work? Here are a few signs to watch for:

- Founders are involved in every deal: High-level execs still approve proposals and join client calls that account managers could handle. Every hour founders spend in these meetings is an hour they’re not building the business.

- Account managers can’t focus on selling: They’re answering emails about deliverables instead of nurturing upsell opportunities. But you’re paying them to grow revenue from existing clients, not chase timesheets.

- Team leads act as HR: Senior consultants conduct performance reviews instead of mentoring junior staff or refining your service delivery methods. They should be focused on building talent, not handling HR tasks.

- Ops feels chaotic: Ops responsibilities fall on individual contributors (ICs), who’re forced to cobble together their own resource plans. There’s no single source of truth or clear processes.

Use this self-assessment checklist to gauge if you need some non-billable support.

For each area below, ask yourself: “Who actually owns this today?”

If the answer falls in the “Billable Talent” column, you have a resource allocation problem.

| Function | Dedicated support (healthy) | Billable talent (leakage) |

|---|---|---|

| Employee Onboarding & Reviews | People Ops Manager | Founder / Team Leads |

| Quoting & Proposals | Business Development | Specialists / Delivery Team |

| Resource Planning | Ops / Resource Manager | Delivery Leads / ICs |

| Billing & Invoicing | Finance / Admin Support | PMs / Account Leads |

| Reporting | Ops / Finance | Execs (Manual Spreadsheets) |

3 types of non-billable hires that unlock growth

Delaying non-billable hires is not a cost-saving strategy; it is a leading cause of margin erosion. Waiting too long creates a cycle of burnout, turnover, and client dissatisfaction.

Diagnose your firm’s specific bottleneck to determine which role will provide the highest immediate leverage.

1. Operations manager

Hire one if: Delivery leads are managing schedules, utilization, and staffing—in addition to all their client work.

An operations manager brings structure to resource planning and forecasting. This role also handles day-to-day coordination so your delivery team doesn’t have to. They’re responsible for:

- Balancing workloads across teams to avoid overworking anyone or leaving anyone with too little billable work

- Improving billable utilization so your firm can hit utilization targets and profitability goals

- Flagging signs that it’s time to hire (like team members consistently exceeding 85% utilization) so you can bring in new team members before burnout hits and work quality suffers

Further reading: Ops as an Enabler: Improving Delivery Team Productivity

2. Finance manager

Hire one if: Billing is super manual and frequently leads to delayed invoices, or project managers are responsible for sending invoices and chasing payments.

A finance manager establishes processes that streamline invoicing and reporting to improve cash flow.

This role also gives leadership a real-time picture of financial KPIs so the firm can make informed decisions about growth.

They’re responsible for:

- Automating invoicing so invoices are never delayed

- Speeding up cash collection so clients are never delinquent

- Connecting delivery and financial reporting so your team can make more informed decisions about clients and hiring

3. People operations (HR)

Hire one if: Senior leaders are spending hours on performance reviews, onboarding new hires, or managing team conflict instead of billing.

A People Ops manager takes the administrative burden of “managing people” off your billable leaders. This allows your senior talent to focus on mentorship and craft rather than paperwork.

They’re responsible for:

- Ensuring new hires are productive in weeks, not months, without pulling senior staff into every administrative session

- Running the review process so team leads only have to provide the feedback, not manage the logistics

- Owning employee satisfaction to prevent costly turnover—which protects margins by avoiding recruitment fees and lost productivity

But, which role comes first?

Don’t hire based on what you dislike doing—hire based on what threatens the business the most. For most firms, the “Hierarchy of Needs” is:

- Operations (The Foundation): Hire this first. You cannot scale if delivery is chaotic. If you skip this step, you are simply recruiting people into a burning building.

- Finance (The Fuel): Hire this second. Once delivery is stable, you need cash flow visibility (not just a bank balance check) to safely fund bigger risks.

- People Ops (The Growth): Hire this third. Only when the machine is stable (Ops) and funded (Finance) should you bring in HR to systematically feed it with talent.

Many founders hire HR first because they hate recruiting. But if you hire a recruiter before you fix your operations, you’re just pouring new talent into a leaky bucket. Fix the bucket first.

Should you hire Fractional or Full-Time?

Once you know which role to hire, you must decide how much of them to hire.

The biggest mistake firms in the $1M–$5M range make is hiring a full-time junior employee (to save money) when they actually need a fractional senior leader.

According to the 2025 Professional Services Maturity™ Benchmark, firms often lose profitability as they scale.

Firms with 10–30 employees average 12.0% profit (EBITDA), but as they scale to 31–100 employees, profit drops significantly to 8.6%.

The reason being because they tend to add overhead faster than revenue. As firms enter this “messy middle,” sales expenses jump by over 50% (from 3.9% to 6.0% of revenue) and G&A costs creep up, causing margins to compress.

To avoid this profit dip, hire fractionally.

At $2M in revenue, you likely don’t need a full-time CFO for 40 hours a week. You need a CFO’s strategy for 5 hours a month, and a bookkeeper to handle the daily data entry.

Use this revenue guide to right-size your investment:

| Role | $1M – $3M Revenue (Lean & Agile) | $3M – $8M Revenue (Scaling Up) | $8M+ Revenue (Mature Firm) |

|---|---|---|---|

| Finance | Fractional CFO (Strategy) + Bookkeeper (Execution) | Financial Controller (Full-time) | VP of Finance (Full-time) |

| Ops | Project Manager (Promoted to internal Ops lead) | Director of Operations (Full-time) | COO (Full-time) |

| People | Founder + Admin (Process) | HR Generalist (Full-time) | Head of People (Full-time) |

How to prove ROI before hiring a non-billable role

Acknowledging the need for support is simple; securing the budget is the challenge.

To get leadership buy-in, stop debating feelings and start debating the math.

Calculate the cost of inaction

First, quantify the “Shadow Salary” you are currently paying.

If an exec ($250/hr) spends just 10 hours a week on admin, you aren’t “saving” on a support salary. You are burning $2,500 per week in lost revenue potential. That’s $130,000 per year.

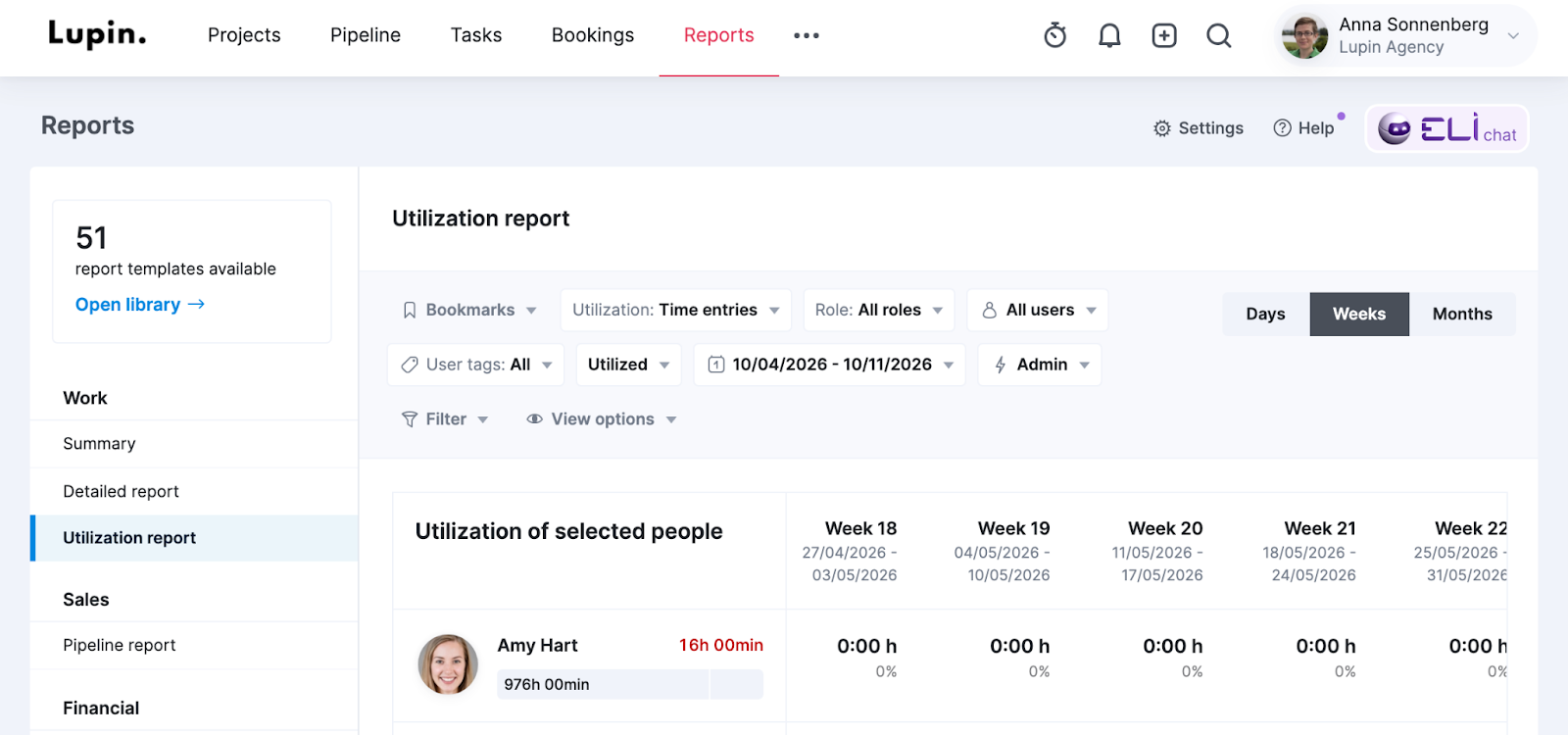

Scoro’s utilization data makes this easy to prove. Use the “Utilization” report to show how much time your senior team is spending on non-billable work:

Perform an “Operational Headroom” test

Don’t use total revenue to judge affordability. It’s misleading if you have high pass-through costs like ad spend or printing.

Instead, look at your gross Income (Total Revenue minus COGS).

According to profitability experts like Marcel Petitpas and Gareth Healey, the healthy range for Admin & Ops spend is 8–12% of your gross income.

- < 8%: You are likely under-investing. As Lindsey Head warns, the business is probably being held together by “duct tape” rather than systems.

- 8–12%: You have the right “operational headroom” to scale without burning out your team

- > 14%: Focus on efficiency before adding headcount

Take your Gross Income and multiply it by 0.10.

For example, imagine an agency with $3M in Revenue and $1M in pass-through costs (like freelancers or media buy).

- Gross Income: $2M

- 10% Target Budget: $200,000

- Current Admin Spend: $120,000 (Includes tech stack, finance costs, and the non-billable portion of leadership salaries)

They have $80,000 in available headroom—enough to fund a strong Ops Manager or a high-level fractional leader.

Be sure to exclude Sales & Marketing costs from this “Admin” calculation; those typically sit in their own separate budget bucket.

Also, interpret the headroom result realistically. A budget of $80,000 might not fund a C-suite executive, but it is plenty for a strong Operations Manager or a high-level fractional leader.

Explain how the change will speed things up, not slow them down

When leadership believes change will only create delays, they’re concerned about disrupting delivery timelines or adding processes that introduce a steeper learning curve before the team sees value.

Reaffirm how much work you can project the non-billable hire will take off people’s plates.

Like this:

- People Ops Manager: “By handing off onboarding and review cycles to a dedicated manager, our Team Leads get back valuable hours every month. This lets them focus entirely on client strategy and mentoring juniors on their actual craft.”

- Ops Manager: “Centralizing and standardizing internal processes means PMs and team leads can spend less time reinventing workflows and putting out fires. Projects will run more smoothly, resulting in fewer bottlenecks and a more predictable delivery experience.”

- Finance Manager: “Taking ownership of forecasting, invoicing, and financial analysis means the leadership team can make more strategic decisions faster and with greater clarity. Projects and resourcing become easier to plan when we have real-time visibility into budgets, revenue, and profitability.”

Have a conversation about previous non-billable roles

When leadership insists they’ve already tried hiring for the role but didn’t see results, they’re bound to be skeptical.

Address their concerns by diagnosing why the previous hire failed. Usually, it comes down to three specific issues:

- Was it a Role issue? (Unclear or wrong responsibilities)

- Was it a Mandate issue? (No authority to enforce processes)

- Was it a Metrics issue? (No clear KPIs to measure success)

Then, respond with a realistic approach to their concerns:

- For a Role issue: Explain how you’ll clearly assign relevant responsibilities so they aren’t just “helping out.”

- For a Mandate issue: Explain how and when leadership will give the new hire appropriate authority to enforce scope or billing rules.

- For a Metrics issue: Explain exactly how you’ll choose and track KPIs using your software.

This addresses their concerns and sets a stronger foundation for success. It also clarifies expectations of what leadership wants from the role so you can make sure the new hire actually meets them.

Role design: How to set your non-billable hire up for success

Ops, People, and Finance hires don’t fail because they lack skills. They fail because they lack a framework to prove their impact.

If you hire a $120k Operations Manager and treat them like a glorified executive assistant, you will destroy their ROI.

Here is how to design the role to drive measurable results from day one.

1. Define specific “Day 30” wins

Founders often get nervous about overhead. They need to see value immediately, not in 90 days. While long-term KPIs (like utilization) take time to move, you can assign a specific “audit” project in the first month to build immediate credibility.

Run a “Day 30” credibility project.

Assign one specific “audit” project for the first month:

- Ops Hire: Audit the last 5 completed projects. Identify exactly where the scope crept and calculate the lost revenue

- Finance Hire: Identify the top 3 clients with the slowest payment terms and enforce the contract to speed up cash flow immediately

- People Hire: Interview every employee and produce a “Theme Report” on why people stay (or leave), giving leadership a clear retention roadmap

2. Create the “Anti-Job” description

Scope creep is the enemy of non-billable roles. Without clear guardrails, your new high-level Ops Manager will inevitably become the office travel agent or party planner.

To protect their ROI, you must define what they do not do. Create an “Anti-Job Description” during onboarding and share it with the team:

| Role | The Strategic Job (DO THIS) | The Anti-Job (DON’T DO THIS) |

|---|---|---|

| Ops Manager | Analyzing utilization trends & fixing resource conflicts. | Booking flights or formatting slide decks for Partners. |

| Finance Manager | Modeling cash flow scenarios & enforcing billing terms. | Scanning receipts or manually entering timesheets for staff. |

| People Ops | Building retention strategies & performance frameworks. | Planning the holiday party or ordering office snacks. |

If they are doing the “Anti-Job,” they are too expensive. Keep them focused on the high-leverage work that protects your margins.

3. Create a scorecard that defines success

Give non-billable hires concrete ways to measure their impact. Otherwise, their value is invisible compared to billable colleagues.

- Improve Billable Utilization: If they take 10 hours of admin off a Delivery Lead’s plate, billable utilization should rise. Track this trend in Scoro.

- Shorten the Billing Cycle: A Finance Manager should cut the time between “work done” and “cash collected.”

- Protect Delivery Margins: An Ops Manager should reduce the variance between “Budgeted Hours” and “Actual Hours.”

Run the business by the numbers—utilization, gross margin by client, labor percentage. Those three tell you the truth.

4. Give them authority so governance sticks

If your new hire is accountable for specific metrics, give them control over the levers that move those numbers.

Grant them permission to approve project scopes, budgets, or time entries so they don’t create another bottleneck.

Scoro’s “Approvals” feature allows you to automatically route change-order requests through Ops or Delivery Leads.

Top Tip

The “Authority Gap” kills more hires than incompetence The biggest threat to your new Ops Manager isn’t a lack of skill. It’s your billable leadership team.

If a senior leader refuses to use the new resource planner because “they’re too busy making money,” your Ops Manager is dead in the water. They cannot enforce process if the partners are allowed to bypass it.

You must explicitly state to your partners: “This Ops Manager speaks with my voice. Ignoring their process is the same as ignoring me.”

Without this political cover, you haven’t hired a manager; you’ve just hired an expensive admin assistant.

Final thoughts

With the right non-billable hire, you can take valuable steps to systemize your business.

But even with the right hires and the right frameworks, disconnected tools still make it hard for new hires to do their jobs well.

If your new Ops Manager has to wrestle with three different spreadsheets to get a utilization number, they aren’t fixing the problem—they’re just managing the chaos.

Case in point: before Scoro, global advisory firm DGA Group managed operations and finance using multiple disconnected systems. This led to inconsistent time tracking, slow invoicing, and manual reporting.

After switching to Scoro, the firm:

- Improved utilization by 20%

- Boosted project profitability by 33%

- Cut invoicing timelines from a week to two days

- Cut reporting timelines from six weeks to two weeks

These wins weren’t a coincidence. They happened because the firm had a solid operations and finance structure and a connected system to power it.

Want to see how Scoro can help your non-billable hires get their own wins? Try us for free for 14 days.